Iran issues NOTAM warning of planned rocket launches on Thursday

Iran has issued a Notice to Air Missions (NOTAM) indicating planned rocket launches across parts of southern Iran on Thursday between 03:30 and 13:30 GMT.

Iran has issued a Notice to Air Missions (NOTAM) indicating planned rocket launches across parts of southern Iran on Thursday between 03:30 and 13:30 GMT.

The second round of Iran–US nuclear talks was met with a muted and often critical reaction in Tehran, where official outlets questioned Washington’s commitment after American negotiators left Geneva within hours despite Iran’s offer to continue discussions.

Iran’s Foreign Minister Abbas Araghchi nonetheless described the talks as positive overall but cautioned that reaching a final agreement would take time. He said both sides agreed to begin drafting potential agreement texts, exchange documents and schedule a third round.

In Tehran, however, many voices sharply criticized what they portrayed as a lack of seriousness on the American side.

The government’s official daily, Iran, accused Washington of “part-time diplomacy,” arguing that the brief visit by US representatives Steve Witkoff and Jared Kushner suggested an oversimplified approach to Tehran’s nuclear file.

“That’s the challenge of negotiating with non-diplomatic figures,” the paper wrote in an editorial, adding that if diplomacy is to replace pressure and tension, it must rely on “a clear and durable decision at the highest political levels.”

‘Side job for businessmen’

Commentators linked the criticism in part to the Americans’ decision to leave Geneva for separate negotiations related to the war in Ukraine, contrasting it with Tehran’s readiness for prolonged talks backed by a large expert team.

Reza Nasri, an analyst close to Iran’s foreign ministry, echoed the criticism on X, writing: “Witkoff and Kushner are treating Geneva like a diplomatic fast-food restaurant… Global stability is not fast food. Serious diplomacy requires focus and real intent, not a side job for businessmen.”

The website Nour News, close to senior security official Ali Shamkhani, also questioned Washington’s priorities in an article titled “Where is the real time-wasting?” It argued that accusations of stalling better applied to the US, which it said relied heavily on media optics and insufficiently specialized envoys.

The diplomatic exchanges unfolded amid heightened rhetoric and military signaling. Ahead of the Geneva meeting, Iran’s Supreme Leader Ayatollah Ali Khamenei reiterated his hardline stance, invoking a historical Shiite reference to stress resistance to US pressure.

Tehran media also highlighted an Islamic Revolutionary Guard Corps (IRGC) naval exercise in the Persian Gulf, describing it as a deterrent message coinciding with nuclear diplomacy.

Iran’s financial markets reacted negatively to the Geneva talks, partly influenced by reports of an increased US military posture in the region. On Wednesday, the Iranian rial weakened again, with the dollar rising nearly 1.2 percent to around 1,630,000 rials.

Risk of talks collapsing

Political analyst Mohammad Soltaninejad cautioned that drafting preliminary texts does not signal a final deal is near.

“Even if agreement is reached on some issues, that does not necessarily mean the US will act accordingly,” he told the news outlet Entekhab.

Soltaninejad said Iran is seeking tangible sanctions relief, while the US may prefer to maintain economic pressure to gain leverage on Tehran’s missile program, raising questions about whether the sides can easily align their economic and security interests.

Another analyst, Mostafa Najafi, said in an online interview that the risk of negotiations collapsing appears higher than scenarios involving even a limited agreement to manage tensions.

Moderate journalist Ahmad Zeidabadi offered a more optimistic assessment, writing on his Telegram channel that the talks still have a chance of success.

He warned, however, that fear of domestic hardliners in Iran or pressure from supporters of Israeli Prime Minister Benjamin Netanyahu in the US could derail a potentially beneficial agreement for both sides.

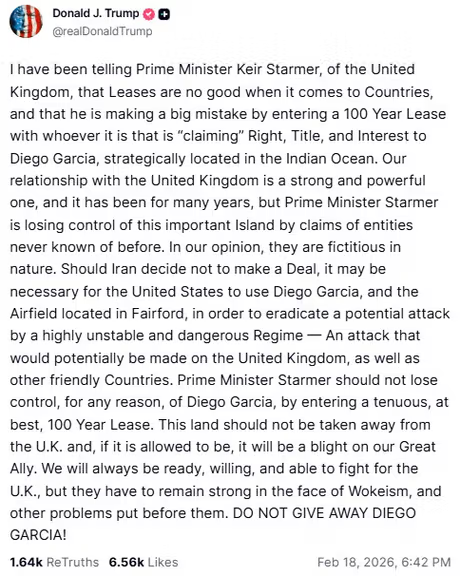

US president Donald Trump said on Wednesday if Iran refuses to make a deal, the United States may need to use Diego Garcia, hinting at possible military action from the strategic Indian Ocean base.

“Should Iran decide not to make a Deal, it may be necessary for the United States to use Diego Garcia, and the Airfield located in Fairford, in order to eradicate a potential attack by a highly unstable and dangerous Regime — An attack that would potentially be made on the United Kingdom, as well as other friendly Countries,” Trump posted on Truth Social.

"There are many arguments one can make in favor of a strike against Iran. President Trump prefers diplomacy. Iran would be wise to make a deal,” White House press secretary Karoline Leavitt said on Wednesday.

“There was a little bit of progress made (during Iran-US talks in Geneva), but we’re still very far apart on some issues. I believe the Iranians are expected to come back to us with some more detail in the next couple of weeks, and so the President will continue to watch how this plays out,” Leavitt added.

The UN Special Rapporteur on the situation of human rights in Iran said she is strongly critical of any potential US military action against Iran.

"I am very critical of any kind of military action without the approval of the UN Security Council," Mai Sato said in an interview with Spanish newspaper, El País.

"When there has been military action elsewhere, it has not provided clear solutions. I do not see military action as a magic solution to resolve the problems in Iran," she added.

When asked whether the Islamic Republic had committed crimes against humanity during recent protests, Sato said, “It would be very irresponsible of me to say yes, because this is a very serious accusation that requires investigation.”

"Even if we ask ourselves 'Why can’t we define it that way?' The answer is that we don’t act that way in our own criminal justice systems either. I wouldn’t define someone as a murderer without a conviction for that crime, even if there are videos showing the alleged crime," she added.

Capital flight from Iran is accelerating just as oil revenues decline, according to new data from the Central Bank of Iran—a convergence that helps explain the sharp fall of the national currency in recent months.

Central bank (CBI) figures show that, even before accounting for sanctions-evasion costs or discounts offered to Chinese buyers, the nominal value of Iran’s oil exports fell about 10 percent to $30.7 billion in the first half of the current Iranian fiscal year, which began on March 21, 2025.

Additional CBI data show that the nominal value of Iran’s total exports—including oil, non-oil goods and services—reached about $59 billion in the first six months of the fiscal year, while imports totaled roughly $48 billion.

On paper, that left a trade surplus of $11 billion. Yet during the same period, nearly $15 billion in capital left the country. That’s a record outflow that more than offset the surplus.

The outflows appear to be intensifying as Iran remains suspended between uncertain nuclear negotiations and the persistent risk of military escalation.

Earlier this month, US Treasury Secretary Scott Bessent said Iranian leaders were “wiring money out of the country like crazy,” but did not offer any more details.

CBI does not specify how much revenue was lost through sanctions circumvention. But a member of parliament’s Budget and Planning Commission recently said Iran earned only $20 billion from oil exports in the first eight months of the fiscal year—far below the nominal value of shipments.

Put simply, Iran’s actual oil income over eight months was substantially lower than the nominal value of exports recorded over six months, pointing to significant losses through price discounts and restricted access to proceeds.

Even those reduced revenues have not fully reached the government. Last month, Gholamreza Tajgardoon, head of parliament’s Joint Budget Commission, said only $13 billion of the $20 billion in oil export earnings had actually been received.

The figures underscore a dual constraint: Iran is not only earning less from its oil exports but is also struggling to access the revenue it does generate, limiting its ability to finance imports or stabilize domestic markets.

The gap has forced the government to rely increasingly on domestic borrowing.

Central bank data show that by November 2025, government debt to the banking system had risen 41 percent from a year earlier, while its debt to the central bank surged 68 percent. Commercial banks’ own borrowing from the central bank rose 63 percent over the same period.

In effect, the state has compensated for lost oil income by drawing on the banking system and expanding the money supply. Liquidity—a key driver of inflation and currency depreciation—rose more than 40 percent in November 2025 compared with a year earlier.

The consequences are visible in the exchange rate. The rial has depreciated roughly 75 percent since February last year.

Taken together, declining oil revenues, restricted access to export proceeds, record capital flight and rapid monetary expansion are reinforcing one another.

The prolonged state of geopolitical limbo appears to be amplifying those pressures, encouraging businesses and elites alike to move assets abroad and leaving the economy increasingly exposed to further instability.