The Supreme Audit Court said in a statement that documented gasoline import costs had reached $1.8 billion by late December, adding that even under a high-end scenario, total imports for the full year would amount to around $2.7 billion, well below the president’s estimate.

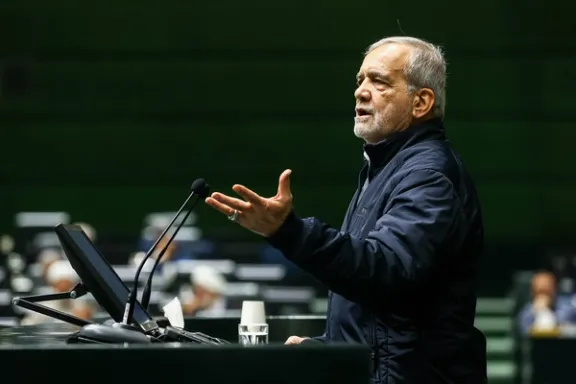

Pezeshkian had told parliament earlier this week that the government spent about $6 billion importing gasoline this year, while budgeting roughly $8 billion in subsidized foreign exchange next year for essential imports, even as many goods were effectively priced at market exchange rates.

The president cited fuel and energy subsidies as a central distortion in Iran’s economy, arguing that higher consumption channels larger amounts of state support to wealthier households. He described the current system as inequitable and unsustainable, particularly as domestic fuel demand continues to rise.

The audit body warned against the use of inaccurate or unverified financial data in policymaking, saying that decisions on energy shortages and broader economic reforms should be based on “precise, transparent and verifiable information.”

The dispute comes as Iran grapples with chronic fuel shortages, rising imports and a widening gap between domestic production capacity and consumption. Officials have said inefficient vehicles, smuggling and low prices have pushed gasoline demand well beyond refinery output, forcing imports despite Iran’s status as a major oil producer.

While the audit court challenged the scale of gasoline imports, it did not dispute broader concerns over subsidies, which economists say absorb tens of billions of dollars annually and weigh heavily on public finances.

A reformist daily, Etemad, said in an editorial on Monday that Iran’s budget debate reflects a deeper problem: a persistent gap between official plans and economic realities.

“The distance between what is written on paper and what happens in practice remains deep and worrying,” the paper wrote, adding that promises to reform spending and target resources have repeatedly translated into pressure on “transparent and productive” sectors rather than on inefficient or tax-exempt entities.

The editorial argued that quasi-state and semi-private companies continue to operate in a “safe zone,” contributing little in taxes despite controlling a significant share of economic resources. “A large portion of national resources circulates within this gray structure without an effective return to the public budget,” it said.

The paper also warned that a 25% rise in bond issuance signaled growing reliance on borrowing, shifting fiscal pressure into the future without generating sustainable growth.

The gasoline cost dispute adds to pressure on Pezeshkian’s government as lawmakers review the budget for the Iranian year beginning in March, against a backdrop of high inflation, currency weakness and public frustration over living costs.

The dispute unfolded as shopkeeper protests linked to the rial’s plunge continued in Tehran for a second day on Monday.