More Stories

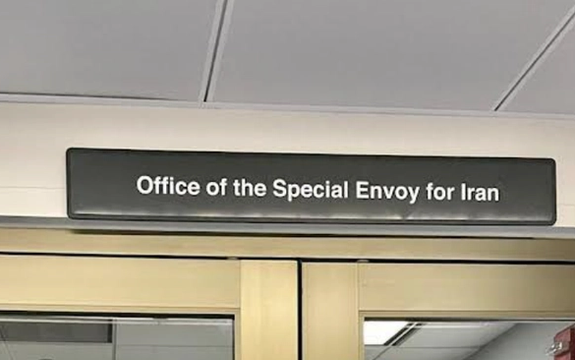

A draft executive order circulating among US diplomats proposes the elimination of dozens of positions at the State Department including the office of Special Envoy for Iran and the transfer of its functions to Special Envoys to Middle East and the Iran Desk under MEC, according to the document first seen by The New York Times.

Secretary of State Marco Rubio rejected the document which was later obtained by several other mainstream media as "fake news".

However, the Trump administration has not appointed a new envoy for Iran since his inauguration, and Special Envoy for the Middle East Steve Witkoff has been in charge of nuclear talks with Tehran.

Iran's IRGC Navy Commander Alireza Tangsiri says the United States is "incapable" of challenging the Islamic Republic's maritime dominance.

“We have built a vessel that is better than similar American models; when the time comes, we might unveil it,” he added in a televised interview on Sunday,

Tangsiri also vowed “decisive retaliation” against any aggression toward Iran's oil tankers or territorial waters.

Iran's Foreign Minister Abbas Araghchi in a phone call with his Swiss counterpart Ignazio Cassis briefed him on the latest talks with the United States, and praised Switzerland's role in 2011 nuclear negotiations between Tehran and world powers.

Cassis, in turn, expressed his country’s readiness to provide any kind of assistance in this regard, according to the Iranian Foreign Ministry's readout of the call.

Switzerland represents US interests in Iran since Washington and Tehran cut ties shortly after the 1979 Islamic Revolution.

In another phone call on Sunday, Araghchi also briefed his Pakistani counterpart Mohammad Ishaq Dar on the latest developments in Iran-US talks.

Touraj Atabaki, a senior researcher at the International Institute of Social History, says analyzing China's role in the negotiations between Tehran and Washington is simpler than analyzing Russia’s approach.

“China wants the Red Sea waterway to remain a steady route for its growing trade, and is currently pleased that, thanks to the efforts of the United States, the Houthis' activities have decreased," he told Iran International.

Atabaki added, “China is very eager that Iran-US negotiations can prevent a potential Israeli or American war against the Islamic Republic, so that its relationship with the Persian Gulf countries can progress, and along with that, the famed and historic Silk Road can reach a successful outcome.”

A sharp rise in the price of opium in Iran has driven long-time users of the traditional narcotic toward cheaper and more dangerous synthetic alternatives, according to a field report published by Tehran-based daily.

The Haft-e Sobh paper cited market data showing a 32 percent year-on-year increase in opium prices in April, bringing the average cost to around 1.64 million rials per gram—equivalent to roughly $2.

The rial fell sharply after the start of Iran-US nuclear negotiations, trading at 820,000 to the dollar. Based on this rate, the current opium price range of 1.3 to 2 million rials per gram translates to $1.58 to $2.44.

“The price hikes in the past two years have been astronomical,” one user told Haft-e Sobh. “People can’t afford opium or its derivatives like opium extract anymore. Many have switched to industrial drugs instead.”

Over the past five years, the average price of opium has more than doubled. In 2020, it stood at around 750,000 rials per gram ($0.91), rising to 1.2 million rials ($1.46) in 2023 and now averaging 1.64 million rials ($2).

For much of the last decade, black-market opium prices had risen more slowly than Iran’s official inflation rate. But that gap has now narrowed considerably. Official inflation in the past year was 33.4 percent, nearly mirroring the 32 percent jump in opium prices.

The shift in affordability has triggered a broader change in consumption. A February 2025 field report by the Etemad newspaper found that the use of traditional narcotics like opium has declined sharply in the past seven years, with heroin and methamphetamine becoming more prevalent.

Unlike opium, meth is often easier to manufacture domestically and does not rely on cross-border supply chains.

Much of the current scarcity is linked to the Taliban’s ban on poppy cultivation in Afghanistan, enacted in early 2022. Taliban forces destroyed large swathes of opium poppy fields, disrupting regional supply and pushing up prices.

In July 2022, Iran’s Tejarat News website reported that prices had spiked nearly sixfold before partially stabilizing.

Meanwhile, as demand remains high, reports of poppy cultivation inside Iran have surfaced despite official crackdowns. Government-linked media recently aired footage of poppy fields being destroyed in southern provinces.

In one case from March, footage released by the Baloch Activists Campaign showed armed raids by Iranian forces on the village of Esfand in Sistan and Baluchistan province, aimed at destroying local poppy farms.

In 2022, the UN office on drugs and crime (UNODC) reported that an estimated 2.8 million people suffer from a drug use problem in Iran. The country also has one of the world’s highest prevalence of opiate use among its population.