Iran's Renewables Ambitions Dwindle Amidst Regional Surge

Iran fell significantly short of its renewable energy capacity expansion target for the last fiscal year, which ended on March 19.

Iran fell significantly short of its renewable energy capacity expansion target for the last fiscal year, which ended on March 19.

The country only managed to add less than 75 megawatts (MW) of renewable energy capacity, whereas the initial projection had aimed for an addition of 2,500 MW – realizing just 3% of its renewables growth goal.

The latest statistics from the Energy Ministry indicate that there was a relatively small increase in new renewable energy infrastructure during the last fiscal year, with less than 11 MW of new wind farms and 64 MW of photovoltaic solar farms installed.

Interestingly, 37% of these installations became operational within the past week.

Iran’s total renewable energy capacity currently amounts to 879 MW, which represents less than 1% of the country's total nominal electricity generation capacity.

The country currently confronts a substantial electricity deficit of 14,000 MW during peak summer demand. Compelled by severe droughts and escalating air pollution, the nation has little recourse but to prioritize the expansion of renewable energy sources as its sole viable solution.

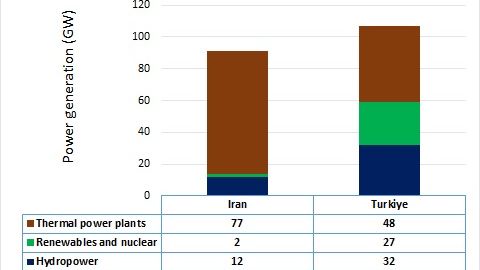

During the last fiscal year, Iran produced approximately 380 terawatt-hours (TWh) of electricity. Among the sources of electricity generation, nuclear power and renewables each contributed 1%, while hydropower plants accounted for 4.4%. The majority of electricity generation, 93.5%, came from thermal power plants. Notably, Iran's thermal power plants are substantial consumers of natural gas, using over 70 billion cubic meters annually, as well as significant quantities of dirty mazut and diesel fuels, totaling 20 billion liters per year.

Iran's greenhouse gas emissions have doubled since 2000, soaring to approximately one billion tons annually. As the sixth-largest emitter of greenhouse gases worldwide, Iran grapples with significant air pollution challenges, especially in major cities like the capital, Tehran. Clean air remains a rarity, with only 3-4 days of such conditions experienced throughout the last year.

Despite benefiting from 300 sunny days annually and vast windy mountainous and coastal areas, the Islamic Republic has not prioritized the flourishing of clean energy sources.

Iran Trails as Neighbours Forge Ahead

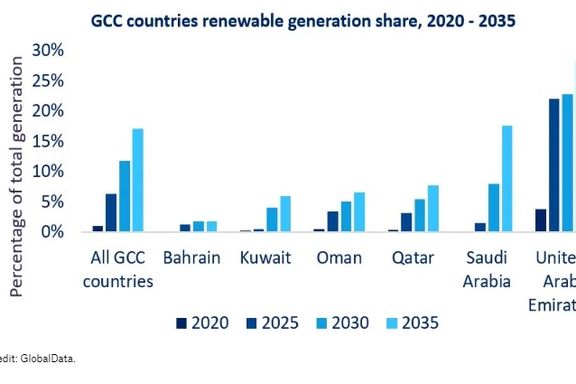

In 2023, Turkey increased its renewables capacity by 2,840 MW, while Saudi Arabia tripled its figure to 2,800 MW during the same period. Additionally, Turkey aims to add 7,000 MW of renewables capacity in 2024.

Currently, renewables (solar, wind, biomass, geothermal) and hydropower collectively account for approximately 59% of Turkey's nominal power generation capacity. In contrast, in Iran, this figure stands at about 15%.

It's worth noting that Iran's actual hydropower generation only contributes 4.4% to electricity generation, significantly lower than its nominal capacity of 12%, largely due to drought conditions.

The Energy Information Administration recently predicted that renewable capacity expansion in the Middle East and North Africa is set to increase by 62 gigawatts (GW) between 2023 and 2028.

Over the next five years, the pace of growth is expected to accelerate to more than three times that of the previous five-year period, with solar photovoltaic (PV) installations accounting for over 85% of the increase.

More than one-third of the growth will occur in Saudi Arabia alone, with significant contributions also expected from the United Arab Emirates, Morocco, Oman, Egypt, Israel, and Jordan. Together, these seven countries are projected to account for over 90% of the region's growth in renewable energy capacity.

Additionally, Saudi Acwa Power and the UAE's Masdar companies have signed major projects with Iran's northern neighbors to develop their renewable energy projects.

In November 2023, Masdar launched Azerbaijan's 230 MW solar farm and entered into a joint project with Acwa and Azerbaijan's state-run oil company, Socar, to develop 500 MW of renewable energy in the Nakhchivan Autonomous Republic of Azerbaijan.

ACWA Power is currently in the process of developing a 240 MW wind power plant in Azerbaijan. Additionally, the company signed four implementation agreements in early 2023 for the development of a 1 GW onshore wind farm and a 1.5 GW offshore wind farm with Azerbaijan.

Azerbaijan has also inked numerous contracts with companies such as French Total and British Petroleum to expand the capacity of solar and wind farms to 10,000 MW by 2030.

The Saudi company has also entered into multiple renewable energy contracts with Uzbekistan, including the construction of a 2400-MW wind power plant. Additionally, agreements have been made for the development of a plant with a 3000-ton/year hydrogen production capacity and another plant with a 500,000-ton/year green ammonia production capacity. It launched the first wind turbine in Bukhara during the previous summer.

Acwa Power also secured an agreement with Kazakhstan last year to construct a 1000- MW wind farm.

In 2023, Kazakhstan inaugurated 16 renewable energy facilities with a total capacity of 496 MW. The country's current renewables capacity stands at close to 3000 MW, with plans to ramp it up to 6,700 MW by 2027.

Iran's southern neighbor, Oman, has initiated the development of its large-scale hydrogen project. As per the International Energy Agency, Oman intends to produce a minimum of 1 million tons of renewable hydrogen annually by 2030, scaling up to 3.75 million tons by 2040, and potentially reaching 8.5 million tons by 2050. This ambitious plan would surpass the current total hydrogen demand in Europe.

Qatar meanwhile has commenced the construction of a blue ammonia project with a capacity of 1.2 million tons per year in 2022.