Oil prices fall on hopes of US-Iran nuclear deal

Oil prices fell sharply on Thursday as signs of progress in US-Iran nuclear negotiations and an unexpected rise in US crude inventories raised concerns about a potential supply glut.

Oil prices fell sharply on Thursday as signs of progress in US-Iran nuclear negotiations and an unexpected rise in US crude inventories raised concerns about a potential supply glut.

Brent crude futures dropped as much as 3.7% to $63.68 a barrel in early trade before paring losses to $63.98. US West Texas Intermediate (WTI) crude fell 3.3% to $61.05.

The sell-off followed remarks by US President Donald Trump, who said Washington was in "very serious negotiations with Iran for long-term peace" during his tour of the Persian Gulf, adding that Tehran had "sort of" agreed to US terms for a possible deal.

Traders view a possible agreement as a step toward easing sanctions on Iran, which could pave the way for the return of Iranian oil exports to global markets.

Adding to the downward pressure, data released late Wednesday showed an unexpected build in US crude inventories last week, fueling concerns about oversupply.

"The market is reacting to both the political developments and the inventory surprise," said a trader at a London-based commodities firm. "Any indication that Iranian barrels could re-enter the market weighs on prices."

Earlier this week, markets rallied on a US-China trade truce and a flurry of investment deals unveiled during Trump's visit to the Middle East.

Still, oil markets remain volatile as investors weigh the potential timing and terms of any US-Iran agreement, along with broader macroeconomic risks.

US President Donald Trump said on Thursday that Iran had “sort of agreed” to American terms in ongoing nuclear negotiations, suggesting a breakthrough in the long-running standoff may be imminent.

“We’re getting very close to a deal,” Trump told reporters. “You probably read today the story about Iran has sort of agreed to the terms. We're not going to be making any nuclear dust in Iran.”

Trump emphasized that his administration’s core demand remains unchanged: “They can’t have a nuclear weapon. That’s the only thing. It’s very simple.”

Iran has enough enriched uranium to produce several nuclear warheads and could do so within months, International Atomic Energy Agency Director General Rafael Grossi said last month.

Trump said Tehran now has two options moving forward, either diplomatic or military.

“There’s a very, very nice step. And there’s a violent step, the violence like people haven’t seen before,” Trump warned. “I don’t want to do the second step. Some people do. Many people do. I don’t want to do that.”

Trump’s remarks came while Iranian officials signaled readiness to accept significant constraints on the country's nuclear activities.

In an interview with NBC News published Wednesday, Ali Shamkhani, a senior adviser to Supreme Leader Ali Khamenei, said Tehran was prepared to stop enriching uranium to weapons-grade levels, reduce its stockpile, and allow international inspections — if the United States lifts economic sanctions.

Asked whether Iran would sign such a deal immediately, Shamkhani responded: “Yes.”

“It’s still possible,” he said. “If the Americans act as they say, for sure we can have better relations,” after decades of animosity, the two having broken diplomatic ties in 1979 after the Islamic Revolution.

Trump, speaking at a state dinner in Doha alongside Qatar’s Emir Sheikh Tamim bin Hamad AlThani, said he hoped the situation would be resolved peacefully. “We want to see Iran do well and thrive and be successful,” he said. “We want to have this end peacefully, not horribly.”

He added that his administration was “in very serious negotiations with Iran for long-term peace” and suggested that he views himself as a moderate voice. “In a certain sense, I guess I’m a good friend [to Iran], because a lot of people would rather have me take a much more harsh road,” he added.

Iranian President Masoud Pezeshkian and senior officials issued a sharp rebuke to Trump on Wednesday, following a blistering speech in Riyadh in which Trump accused Tehran of destabilizing the Middle East and mismanaging its economy.

Pezeshkian, speaking in Kermanshah on Thursday, condemned US policies as the true source of regional bloodshed, citing civilian deaths in Gaza as the US supports its ally Israel against Iran-backed militant group Hamas, and US arms sales to Persian Gulf states. "Is it us who are the threat, or those who flood this region with bombs?" he said.

Iran’s foreign ministry accused Trump of attempting to sow division between Iran and its neighbors, with spokesman Esmail Baghaei calling the Riyadh speech a “deliberate move” against regional unity.

Tehran maintains it is not seeking nuclear weapons but vowed to continue uranium enrichment.

Iranian lawmakers said on Wednesday that Iran can enrich up to 93% if deemed necessary, while Foreign Minister Abbas Araghchi proposed a regional enrichment consortium with Arab and US participation, in talks mediated by Oman.

The fourth round of indirect talks between the US and Iran in Muscat ended with Iranian officials warning that continued US pressure could derail progress.

Araghchi also criticized Trump’s earlier remarks in Riyadh, calling them “delusional” and blaming US policy for the country’s economic problems.

Still, Trump, traveling through the Persian Gulf region, projected optimism. “We’re going to try and get it done. They have to move quickly,” he said.

While refraining from directly threatening military action, Trump said that the US would take “all action required” to prevent Iran from obtaining a nuclear weapon.

Trump began his Middle East tour in Saudi Arabia on Tuesday, where he stressed economic ties and regional alliances over military confrontation.

At the GCC summit in Riyadh, he urged Iran to end its support of military proxies in the region, accusing the Biden administration of empowering Tehran and abandoning traditional US allies.

Iranian President Masoud Pezeshkian delivered a fiery response on Wednesday to his American counterpart’s speech in Riyadh the previous day in which Donald Trump accused Iran’s leaders of mismanagement and destabilizing the Middle East.

Pezeshkian rejected the allegations in sweeping terms, turning the blame on Washington and its allies.

“Did we kill sixty thousand women and children in Gaza within a year, under bombs and missiles? Did we cut off water, bread, and medicine from those poor people? Are we the threat?” he asked in a speech in Kermanshah in western Iran.

Referring to US arms sales to Iran's Arab neighbors, Pezeshkian said, “When they boast of having missiles and bombs beyond imagination, is it us who are causing war and bloodshed—or is it them, who flood this region with weapons and ammunition?”

“You want the countries of this region to turn on each other by handing out bombs and missiles, and then you say you are peace-seekers?” he added.

Soleimani killing

Pezeshkian also reminded Trump that he was the one who ordered the killing of Iran's top military commander Qassem Soleimani in 2020, saying, "Soleimani was the man who stood against ISIS—the same ISIS you trained, supported, and nurtured. And now you claim you defeated them?”

Iranian officialdom had seethed at Trump for years after Soleimani's assassination, and the US Justice Department in November unsealed murder-for-hire charges against an Afghan national it said was tasked by Iran’s Islamic Revolutionary Guard Corps with killing Trump.

However, the issue of avenging Soleimani's killing had been somewhat dulled down in recent months amid Trump's renewed campaign of 'maximum pressure' and calls to make a fresh nuclear deal.

“If they martyr our great figures, hundreds more will rise from this land to build this nation," Pezeshkian said.

Responding directly to Trump’s comments about Iran’s internal struggles, Pezeshkian said, “Trump is doing everything he can to sow seeds of division, despair and conflict among the Iranian people. He can only dream of that. All Iranians will stand up for their country with all their might.”

On Iran’s domestic resilience, the president said the Islamic Republic had withstood more than four decades of pressure. “For 47 years, they’ve used all their power to try to bring this system and this people to their knees—and they couldn’t. And they won’t be able to.”

"The kind of pressure they’ve put on Iran—if it had been put on any other country, it wouldn’t have lasted 24 hours.”

His comments came one day after Trump's sharp criticism of Iran's leadership in a lengthy speech in Saudi Arabia.

"Iran's decades of neglect and mismanagement have left the country plagued by rolling blackouts lasting for hours a day ... While your skill has turned dry deserts into fertile farmland, Iran's leaders have managed to turn green farmland into dry deserts as their corrupt water mafia ... causes droughts and empty river beds. They get rich," the US president said.

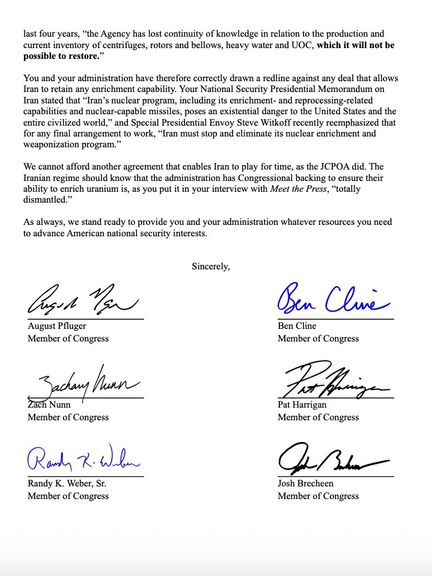

A large bloc of Congressional Republicans is urging US President Donald Trump to maintain a hardline stance on Iran, calling in an open letter signed by more than 200 lawmakers for the complete dismantling of Iran's uranium enrichment technology.

All Republican senators except one, along with 177 GOP representatives, signed the letter warning against any agreement resembling the 2015 nuclear deal brokered under former President Barack Obama.

That accord, they argued, merely delayed Iran’s nuclear ambitions while allowing it to continue enrichment activities under international oversight.

“The United States cannot afford another deal that gives Iran room to maneuver,” the lawmakers wrote. “The regime must be stripped of all enrichment capacity — even for peaceful energy purposes.”

Rand Paul of Kentucky was the only Republican who did not endorse the letter led by Senator Pete Ricketts of Nebraska and Representative August Pfluger of Texas.

Citing what they described as Iran’s expanding nuclear program, the Republicans expressed skepticism over the possibility of verifying any future agreement that permits enrichment.

“The scale of Iran’s nuclear activity today makes verification of any such deal impossible,” the letter said.

The message comes as the fourth round of US-Iran talks concluded without a breakthrough, and Trump is on a diplomatic tour of Iran's Arab neighbors.

The signatories praised Trump’s earlier decision to withdraw from the Joint Comprehensive Plan of Action (JCPOA) and his administration’s “maximum pressure” policy, which reimposed sweeping sanctions on Tehran.

“You have rightly drawn a red line against any deal that permits uranium enrichment,” they wrote. “We stand ready to support your administration with whatever tools are necessary to protect American national security.”

Trump has said that the goal of the negotiations is to achieve "full dismantlement" of Tehran's nuclear program. However, Tehran insists that its enrichment program is not open to negotiation, but it is ready to cap the level of enrichment.

When US President Donald Trump torched Iran’s leadership in a long speech in front of Saudi Arabia’s crown prince in Riyadh on Tuesday, he likely didn’t anticipate how warmly his words would resonate with many Iranians—or perhaps he did.

Across Persian-language social media, many users were almost in awe, surprised with both the content and tone of Trump’s speech. Even journalists inside Iran couldn’t help risking reprimand by praising a US president.

“It was so intelligent of Trump to highlight issues such as the destruction of monuments and the water mafia,” renowned journalist Sadra Mohaqeq wrote on X. "And what a coincidence that he said all this on the same day he lifted US sanctions on Syria."

In his speech in Riyadh, Trump described the Islamic Republic as a “destructive” force, accusing the rulers in Tehran of “stealing their people’s wealth to fund terror and bloodshed abroad,” just as neighboring Arab leaders were building their countries.

"No one could have described the situation of a plundered country in a few sentences better than Trump," Middle Eastern Studies student Masoud Paydari posted on X.

"He uttered the harshest and most bitter words with complete politeness," a classmate commented under his post.

Trump had no good words for Iran’s supreme leader Ali Khamenei but all the world’s praise for Mohammad Bin Salman. Still, he left the door open for a “better and hopeful future” if Tehran chose to change course.

"He spoke as if he were a fellow Iranian chatting with a friend. His words were so clear. Iran’s officials should die of shame," user Maryamgh wrote on X. Many agreed, suggesting that an Iranian writer may have helped draft the US President’s speech.

Trump’s comments on Iran’s nuclear program were largely overlooked by Iranians on social media. It was his lengthy and detailed remarks about mismanagement, economic waste and cultural neglect that clearly struck a nerve.

"In a country on the southern part of the Persian Gulf, major international investors line up to offer cooperation, while another country on the northern part of the same gulf is left with no trade partners,” a user posting as Cryptosamz wrote on X, “because all its officials, from top to bottom, are thieves."

While social media users reacted with rare openness, Tehran’s major dailies remained conspicuously silent. Under apparent pressure not to credit Trump in Iran's tightly-controlled media landscape, they avoided the speech altogether.

Hardliners largely ignored it as well.

Kayhan, whose chief is appointed by Khamenei, was the only paper to address the speech directly, dismissing it as "reckless" with little elaboration. The IRGC-linked Javan stuck to its combative line. "We won’t negotiate if they insist on zero enrichment," read the headline.

State media covered Trump’s visit without pointing out its economic significance.

The wealth being amassed on the other side of the Persian Gulf was derided as mere "petrodollars," with no words of self-reflection on why they freely sell oil, reinvest profits, and fund global ventures as Iran—sitting on comparable if not superior natural resources—struggles to meet basic needs like water and electricity.

Iran's Supreme Leader Ali Khamenei issued one of his strongest denunciations of the West and Israel in recent months, vowing that the Islamic Republic would continue to confront what he described as Western-backed “savagery and bloodshed.”

"Standing up against the crimes and barbarism of the Zionist regime in Gaza and the West's support for this bloodshed is a collective duty," Khamenei told a group of Red Crescent Society rescue workers on Monday.

"Today, the world is being run by these human-like beasts, and the Islamic Republic considers it its duty to stand against their savagery and bloodshed," he added, according to a readout of his remarks published by his website on Wednesday.

The remarks were among the sharpest since talks between the United States and Iran began last month, and were published after US President Donald Trump lambasted Tehran's foreign and domestic policy in a Riyadh speech on Tuesday.

"It is precisely this sense of duty that drives enemies—like these well-dressed, cologne-wearing, Western savages in suits—to stand against and show hostility toward the Islamic Republic. If we stop opposing their barbarity, they would have no enmity with us," Khamenei said.

"The main issue of the Western bullies as the Islamic Republic's rejection of their false civilization and said: Falsehood is doomed to decline and destruction," he added.