Iranian Government’s Annual Borrowing Reaches 30% Of GDP

The Iranian government’s debt surged by 61% during the last budgetary cycle, amid a severe economic crisis, as reported by Parliament’s Research Center on Sunday.

The Iranian government’s debt surged by 61% during the last budgetary cycle, amid a severe economic crisis, as reported by Parliament’s Research Center on Sunday.

The huge jump occurred during the first full year of Ebrahim Raisi’s presidency, dominated by hardliners, who insisted on continuing their anti-Western foreign policy and claiming that economic sanctions imposed on Iran can be defeated. The period spans from March 22, 2022, to March 21, 2023, or the Iranian calendar year 1401.

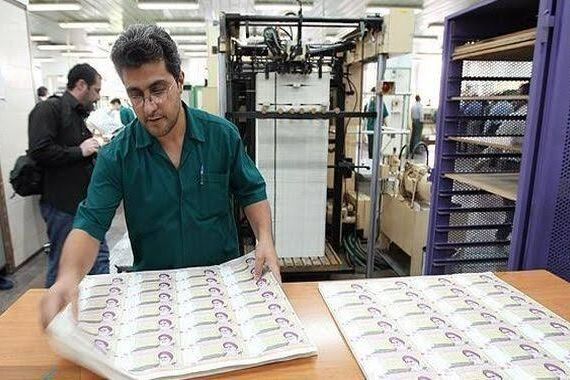

The annual borrowing total reached nearly $50 billion, representing 30 percent of the yearly GDP. This level of borrowing is unprecedented and indicates an increase in money printing by the government, which is likely to result in further inflation, since the borrowing was entirely from domestic state or quasi-governmental banks. In turn, these banks face huge debts and an unstable financial situation. Therefore, when the government borrows from these institutions, they have to turn to the Central Bank of Iran for liquidity and the central bank has to print more money.

To provide context, Turkey's total government debt is equivalent to 31 percent of its annual GDP, whereas in Iran's case, one year's borrowing alone has reached the same level.

This development poses the question about Iran’s increased oil exports in 2022 and 2023, which should have provided financial resources to the government and forestalled more borrowing. During the period in question Iran sold around 1.2 million barrels of oil daily, mostly to China, and with high prices in 2022 it should have brought in at least $26 billion even if sold the oil at the discounted price of $60 per barrel.

Around $11 billion is provided at deeply discounted exchange rates to importers of food, medicine and animal feed. This means that around $5 billion is “wasted” on indirect subsidies. That still leaves around $20 billion for other government expenses, including 15 percent as share of the National Oil Company.

This is basically half of what the government needs from oil exports in order to balance its budget, and it explains why it was forced to borrow more, or to be precise, to print more money. But $20 billion in 2022 was probably more than the government had earned from oil exports in previous years since 2018, when the United States imposed sanctions on Iran’s oil exports.

One explanation about why the government fell into more borrowing in 2022-2023 could be that national reserves dwindled after repeated withdrawals since 2018. A report in August indicated that in the past decade Iran withdrew $140 billion from its National Development Fund, mostly since 2018, leaving an estimated small amount of $10 billion.

Oil exports are said to have increased in recent months reaching 1.5 million and in August surging to around 1.9 million barrels a day, as the United States relaxed its enforcement of sanctions to try to reach a nuclear deal with Tehran.

However, it is not clear how much discount Iran is offering Chinese importers to compete with discounted oil from Russia. In recent days, media in Tehran estimated that the government could be selling its oil for as little as $30 per barrel, given a statement by a top official that it was able to earn just half of what it expected from March to August of this year.

Annual inflation is already hovering at around 50 percent and the national currency has fallen by 50 percent in one year to 500,000 rials per one US dollar. The coming months will show if the higher borrowing will lead to even higher inflation.