Iran Exports To China Halve Since 2022

In its recently released monthly report, the General Administration of Customs of China has revealed a significant decline in Iran's exports to the country during the first six months of 2023.

In its recently released monthly report, the General Administration of Customs of China has revealed a significant decline in Iran's exports to the country during the first six months of 2023.

According to the report, Iran's total export value to China in the aforementioned period was $2.2 billion, representing a 46% reduction compared to the corresponding period last year.

The decrease in Iran's exports to China comes amidst a complex economic landscape that has evolved in recent years due to US sanctions.

Ever since the implementation of stringent US sanctions against Iran in 2020, China has adopted an alternative approach to procure oil from the Islamic Republic. By engaging intermediaries, notably Malaysian brokers, China has managed to secure oil supplies at significant discounts.

The reported figures do not encompass Iran's clandestine oil exports to China, disguised as shipments from other nations, as recorded by Chinese customs. It is estimated that Iran manages to ship approximately 800,000 barrels of oil through indirect means to China due to the constraints imposed by US sanctions.

Conversely, despite the sharp reduction in imports from Iran, China's exports to Iran have experienced a notable upswing, surging by a massive 30% and reaching a total value of $5.3bn.

India, which stands as Iran's second-largest trading partner in East Asia, has also witnessed a decline in imports from Iran. The data from India's Ministry of Economy reveals a 6% drop in imports during the first five months of the current year, leading to a significantly reduced import value of $272 million.

Iran's firebrand Prayer Imams avoided mentioning a sexual scandal by a local hijab enforcement official in Friday sermons or address worsening economic conditions.

Instead, they talked about seemingly unrelated and misplaced issues, while many of their rank and file complain that the social status of the Shiite clergy is declining among ordinary people.

The man who grabbed the public’s attention this week was a hardliner official in the northern Gilan Province, who is married but had sex with a young man. The news immediately went viral after damning videos were leaked on social media.

Homosexuality is a serious crime in the Islamic Republic, and more so in this case when the man was married and was supposed to be a gatekeeper for morality.

He was the director general for Cultural and Islamic Guidance and was removed from his post with unusual speed, unseen in Iran when officials are cut red-handed. The fiasco happened at the worst possible time during the Muharram public mourning ceremonies to mark the the martyrdom of Imam Hussain, the third Imam of the Shiite sect, 1,400 years ago.

Out of the blue, the Imam in Tehran, Ahmad Khatami, said some people believe the money spent on an Islamic festival in Tehran should have been used for taking care of an endangered species of Iranian cheetahs. This had very little to do with the pressing concerns of ordinary people, hit by a 70-percent annual inflation rate, and seemed a bad improvisation to fill the clerics sermon.

In another comment which made sense only in relation to the new round of violent crackdown on Iranian women defying the compulsory hijab, Khatami said those who come out of their houses without wearing headscarf are sick.

He further charged that women without hijab are backward and mentally retarded. In recent days, courts in Tehran have sentenced several movie starts who had appeared in public without headscarves to taking part in counselling sessions and presenting a certificate of mental health to the court.

In another part of his sermon, Khatami said that Muslim nations will make the government of Sweden repent for authorizing the burning of the Quran. Meanwhile, he thanked the government of Iraq, where the protesters had attacked the Swedish embassy, for deporting Sweden's ambassador.

In another development, the Imam in Mashhad, Ahmad Alamolhoda said without presenting any evidence that "the enemies" wish to suppress the clerics who rely on Supreme Leader Ali Khamenei. He further claimed that to do so, the enemies use all powers and means at their disposal.

Regime officials and loyalists use the term “enemies” to refer to the United States and its allies. Similar unfounded statements are made by other clerics and officials who think that Iran’s ruler Ali Khamenei likes to bash “the enemies.”

Alamolhoda, who was the main culprit in a recently disclosed corruption case covered by the Iranian media abroad, presumably made the comment to clear himself of the charges of corruption and to reassure Khamenei that he is the leader's obedient servant in the religious city. It should be noted that the cleric is the father-in-law of President Ebrahim Raisi.

Ironically, on the same date that the Friday Imams made those statements, conservative news website Tabnak called on the country's leaders to bar state officials and clerics from taking advantage of religious values and symbols. Alluding to the scandal in Gilan Province, Tabnak asked in an article on Friday: "How can we justify the behavior of a state official who introduces himself as a 'servant of Imam Hussain' and all of a sudden a leaked video on social media reveals his ethical corruption?" The website added, "Iran's government is a religious government. State officials pretend in public to be devoted to religious values, but some of them take advantage of this. But when these individuals are involved in a scandal the people find out what kind of a monster they were dealing with. As a result, the people are shocked and subsequently become indifferent toward sacred values."

Tehran Stock Exchange (TSE) has witnessed another massive exodus of capital recently with its main index dropping below the critical two million mark earlier this week.

Closing at 1.95m points on Monday after weeks of turbulence, the main index dropped to the levels seen in mid-March. By Wednesday it rose again to slightly over 2 million points.

But this appears to have done little to reassure neither small investors who have withdrawn much of their capital from TSE in recent weeks for the fear of losing all, nor big investment firms.

“The continuation of negative tremors has a key message [for investors]. It is a signal that speeded up the exodus of big investors and resulted in distrust in the market,” Donya-ye Eghtesad newspaper, which focuses on business and economy, wrote Tuesday.

Experts say there are several reasons for TSE’s troubles these days but the decision of the government earlier this week to increase the price of gas it sells to industries which particularly affects the hard currency earning petrochemical industries was the major reason for the capital outflow from TSE.

The few industries with export markets such as steel and petrochemical represent most of the trading in the exchange.

According to Donya-ye Eghtesad, however, in the past few days shares of most companies have dropped irrespective of whether their value is gauged in hard currency, like exporters, or in the national currency rial, such as construction firms and automakers.

“The massive collapse of the stock market is intentional and the managed work of the government,” Dr Mahsima Pooyafard, US-based university professor, said in a tweet Tuesday, arguing that the government of President Ebrahim Raisi has announced several economic decisions such as increasing certain tariffs that highly affect the profitability of the stock market and drive people to dump their stocks. The collapse of the stock market, she said, would help the government to resolve some of its own cash problems.

The index has been in decline due to political uncertainties since May 7, a day dubbed as “the Black Monday of TSE”, with a handful of small peaks when hopes for reviving Iran’s 2015 nuclear deal helped the index rise momentarily.

Since the United States imposed economic sanction on Iran in 2018, the stock market has risen 24-fold. Half of this astonishing rise is because the Iranian currency has fallen 12-fold in the same period and the market has experienced share price inflation.

This phenomenon, the 12-fold rise of the index in real terms, contradicts other economic indices and prices.

Economic journalist Ehsan Soltani in Tehran has pointed out that based on official statistics, since the first quarter of the Iranian calendar year starting on March 21, 2017, Iran's GDP, consumption by families, and the minimum wage have increased by 750, 550, and 470 percent (in rials), respectively.

“But the value of TSE companies has grown by 2,450 percent and the dollar exchange rate by 1,270 percent,” he wrote and argued that the massive increase in the value of TSE companies is not normal and has only been achievable through government manipulation.

Capital market analysts predict funds withdrawn from the TSE by small investors flow to the parallel gold, property, and foreign exchange markets. This will push the exchange rates up and let the government sell its own petrodollars at a higher rate.

The government decision to sell its own assets through the TSE in early 2020, when the index stood at less than 500,000 points, is often cited as an example of manipulation of the stock market.

Small investors were encouraged by the government of President Hassan Rouhani to commit capital to the market amid the decline in the value of the rial. The index rose to 2 million points by mid-year but soon tumbled down to 1.2 million, wiping out the savings of small investors.

At the time, the Rouhani’s hardliner critics alleged that the government had intentionally drawn people to invest in the stock market, mostly representing public and quasi-public companies, to remedy its huge budget deficit.

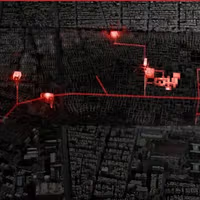

The European Union has taken another step in addressing Iran's military support for Russia's war against Ukraine and its involvement in Syria.

On Thursday, the EU council established a new framework for restrictive measures to counter Iran's role in the proliferation of Unmanned Aerial Vehicles (UAVs), commonly known as drones.

The recently adopted regime specifically prohibits the export of components used in the construction and production of UAVs from the European Union to Iran.

The measures build upon three previously adopted packages of drone-related sanctions that targeted both individuals and entities involved in Iran's drone activities.

In a related development, the EU council decided to add six Iranian individuals to the existing sanctions regimes for their involvement in Russia's war of aggression against Ukraine and support to the Syrian regime's air defense systems.

The urgency of these measures comes amid recent reports from the Irish government about the use of drone components originating from Ireland in a Russian drone shot down in Ukraine.

The Irish Prime Minister, Leo Varadkar, revealed on Wednesday that the Irish government is actively investigating the matter.

Pictures of the recovered drone, reportedly equipped with an Iranian-made Shahed drone part labeled 'Made in Ireland,' were shared on social media by Andriy Yermak, the head of the Office of the President of Ukraine.

Varadkar further acknowledged that third parties might have found ways to circumvent the EU ban on drone components being sold to Russia.

The specific component in question, a carburetor, was marked as being made by the American company Tillotson, which operates a factory in County Kerry, Ireland, as reported by Irish broadcaster RTÉ.

Iran's IRGC navy commander warned that Tehran would retaliate against any oil company involved in unloading Iranian oil from a seized tanker.

Alireza Tangsiri issued the warning as US prosecutors struggled to auction seized Iranian oil from a Greek tanker near Texas.

According to a report by The Wall Street Journal on Tuesday, the auctioning of 800,000 barrels of seized Iranian oil has been met with reluctance from US companies due to fears of Iranian retaliation. Companies with exposure in the Persian Gulf region are particularly wary, with concerns that they could become targets of Iranian aggression.

"We hold the oil company that wants to unload our oil from this ship responsible, and we also hold Washington responsible," Tangsiri declared.

The standoff sheds light on the complexities and challenges faced by the US government in enforcing sanctions against Iran. Iran's increased attacks against Western shipping interests serve as a deterrent to interdicting Iranian exports, making it difficult for the US to proceed with the auction of the seized oil.

In recent months, Tehran's military forces have hijacked several Western tankers in what is seen as retaliation for previous Western seizures of Iranian oil. This ongoing cycle of aggression has escalated tensions in the region and poses significant difficulties for the international community in maintaining stability and maritime security.

In response to the escalating situation, the US Defense Department announced on Monday that it would deploy F-35 jet fighters and a Navy destroyer to the Middle East. The deployment aims to deter further Iranian seizures of tankers and to address Russian aggression in the region.

US State Department Wednesday confirmed earlier reports about a change in Iraq’s payment method to Iran for imports of energy, allowing funds to go to non-Iraqi banks.

Reuters reported Monday that Secretary of State Antony Blinken had signed a 120-day waiver under current US sanctions on Iran to allow Baghdad to pay for Iranian energy imports and deposit such payments into non-Iraqi banks in third countries.

State Department spokesman Matthew Miller confirmed the news during his daily press briefing on Wednesday adding that “The one thing that is different about this renewal is that this latest package also expands the waiver to authorize the transfer of funds from those restricted accounts in Iraq to restricted accounts in select third-party banks.”

Miller emphasized that Iran can use the funds in non-Iraqi banks only to buy non-sanctionable goods, which essentially means food and medicine. He explained, “these funds will remain in accounts where they can only be used for non-sanctionable activity, and with every transaction approved in advance by the Department of Treasury.”

At the same time, The Wall Street Journal reported Wednesday that the US Treasury Department and the Federal Reserve Bank of News York have banned 14 Iraqi banks from conducting US dollar transactions.

The report added that US officials acted against these Iraqi banks after uncovering information that they engaged in money laundering and fraudulent transactions, some of which may have involved sanctioned individuals, raising concerns about benefiting Iran.

The decision to allow Iraqi payments to be transferred to non-Iraqi banks could be related to long-standing suspicions of Iranian money-laundering efforts to transfer US dollars to Iran, which is short of hard currencies.