Data from the commodity intelligence firm Kpler, seen by Iran International, show that in 2025 Iran delivered an average of 1.38 million barrels per day (bpd) of crude oil and gas condensate to China—a decline of just 7 percent compared with 2024.

After Iranian oil exports to Syria halted in December 2024, China effectively remained Tehran’s sole buyer of crude oil over the past year.

Unlike crude oil, Iran’s petroleum product exports—fuel oil (mazut), naphtha and liquefied petroleum gas (LPG)—are relatively diversified, with shipments mainly destined for China, the United Arab Emirates, Malaysia and Singapore.

According to Kpler, Iran exported an average of 190,000 bpd of naphtha and 256,000 bpd of fuel oil last year, a combined decline of about 13 percent compared with 2024.

The drop, however, was driven not by tighter US sanctions but by Iran’s worsening domestic gas shortages, which forced power plants and industrial facilities to burn more fuel oil, reducing volumes available for export.

Data from tanker-tracking firms Kpler and Vortexa show that the modest decline in crude oil exports was offset by increased shipments of natural gas and LPG.

Iran has also continued exporting natural gas to Turkey and Iraq.

Tehran and Baghdad don’t publish official figures, but data from Turkey’s energy ministry indicate that natural gas imports from Iran increased about 9 percent during the first 11 months of last year compared with the same period in 2024.

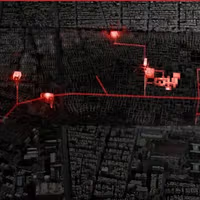

One reason US sanctions have struggled to significantly curb Iran’s energy exports has been the continued operation of the so-called shadow fleet—a network of oil tankers that transport sanctioned crude through flag changes, disabled tracking systems, ship-to-ship transfers, and opaque ownership structures.

According to estimates by TankerTrackers, roughly 1,500 oil tankers worldwide were involved in shadow fleet activity last year, with nearly 40 percent linked to Iranian oil shipments.

Although the United States stepped up sanctions on such tankers in 2025, existing data suggests that hundreds of non-sanctioned vessels remain active in transporting Iranian oil through opaque trading routes and intermediary networks, undermining the enforcement capacity of US measures.

Further data from Kpler indicate that widespread domestic protests in Iran in recent weeks have had no noticeable impact on the country’s oil and petroleum product export volumes.

While China has remained the sole buyer of Iranian crude oil and condensate, the United Arab Emirates—one of Washington’s closest regional allies—has emerged as the largest importer of Iranian fuel oil, accounting for nearly 70 percent of those exports.

Estimates by Iran International put the total value of Iran’s exports of crude oil, petroleum products, and natural gas last year—excluding discounts and the costs of sanctions evasion—at roughly $60 billion.

The figure highlights the gap between early US projections that Iran’s oil exports would collapse by as much as 90 percent and the far more limited impact visible in the data so far.