Lawmakers passed the measure with 144 votes in favor, 108 against, and three abstentions out of 262 present. The reform amends the Monetary and Banking Law to redefine the rial as equal to 10,000 current rials and introduces a new subunit, the qiran or gheran, worth one hundredth of a rial.

Under the legislation, both old and new rials will circulate for up to three years during a transition period. The Central Bank of Iran (CBI) must establish operational procedures within two years of enactment and publicly announce the start of the change through official media.

According to the new law, after the transition period, all financial obligations denominated in the current rial will be settled using the new unit.

The CBI will also be responsible for managing the withdrawal of old banknotes and coins and for setting foreign exchange rates under the country’s current exchange regime.

The plan -- first proposed by the government in 2019 and discussed across three administrations and parliamentary terms -- has undergone multiple revisions. The latest version retains the rial as Iran’s official currency, dropping earlier proposals to rename it the toman.

Shamseddin Hosseini, head of parliament’s Economic Committee, said the measure’s main purpose was to “make banknotes more functional and facilitate financial transactions.”

He added that the abundance of zeros in the national currency had caused accounting and operational difficulties, adding that similar redenominations had been undertaken by countries such as Turkey in 2003 and 2005.

Hosseini acknowledged that cutting zeros would not directly reduce inflation or address Iran’s underlying economic challenges, but called it “an unavoidable adjustment” given years of high inflation and declining purchasing power.

Iran’s central bank governor Mohammad Reza Farzin said in May that the redenomination would take place this year as part of wider banking reforms.

The change, he added, would align official usage with common practice among Iranians, who already express prices in tomans -- equivalent to 10,000 rials.

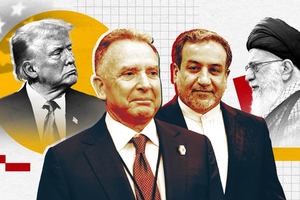

The reform comes amid persistent inflation of about40%, a more than 90% loss in the rial’s value since US sanctions were reimposed in 2018, and widespread economic hardship.

Economists say that while the move could have short-term psychological benefits, it is unlikely to solve Iran’s deeper structural issues, including fiscal imbalances, monetary instability, and limited central bank independence.

“This policy is largely cosmetic,” economist Ahmad Alavi told Iran International in August. “Without tackling the roots of inflation -- from liquidity growth to systemic inefficiencies -- removing zeros will not restore the rial’s value.”

Iran has debated currency reform for decades, with earlier efforts raised under the administrations of Hashemi Rafsanjani, Mahmoud Ahmadinejad, and Hassan Rouhani. The current legislation, delayed several times by the Guardian Council, now returns to the body for final review before becoming law.