International Financial Watchdog Keeps Iran on Blacklist

Financial Action Task Force (FATF) announced Friday that it will keep Iran on its blacklist as it continues to ignore required measures against terrorist financing and money laundering.

Financial Action Task Force (FATF) announced Friday that it will keep Iran on its blacklist as it continues to ignore required measures against terrorist financing and money laundering.

The decision was made following “Iran’s failure to enact the Palermo and Terrorist Financing Conventions in line with the FATF Standards,” the international body stated, further adding that the regime will be considered as a high-risk jurisdiction as long as it chooses not to comply with the FATF’s action plan.

“Until Iran implements the measures required to address the deficiencies identified with respect to countering terrorism-financing in the Action Plan, the FATF will remain concerned with the terrorist financing risk emanating from Iran and the threat this poses to the international financial system,” FATF stressed.

According to FATF, in case Tehran agrees to approve the Palermo and Terrorist Financing Conventions, the body will then decide on the next steps which can include the suspension of international countermeasures.

The Palermo Convention was passed by the UN General Assembly in November 2000 to combat terrorism, human trafficking, and transnational organized crime. The convention is officially called the United Nations Convention Against Transnational Organized Crime (UNTOC).

The Iranian regime has been actively involved in financing terrorism at both regional and global levels. The regime’s proxy groups such as Hamas, the Palestine Islamic Jihad, Hezbollah and Yemeni Houthis have for long been engaged in destabilizing activities which have targeted the peace and security of the region and the whole world.

As an inter-state organization based in Paris, FATF’s recommendations shape banking policies of most countries and businesses who want to protect their own integrity and reputations. Thus, Iran’s international banking is severely impacted by its status in the FATF blacklist.

Amid reports of Tehran selling ballistic missiles to Moscow, a high-level Russian delegation is set to visit Iran next week for an event branded as Commission on Economic and Trade Cooperation.

The delegation, which will consist of about 160-170 directors and experts from various ministries, government organizations, and private sector entities in Russia, is expected to arrive in Tehran on Monday, February 26.

Kazem Jalali, the Iranian ambassador to Moscow, expressed hope that the executive agreement for the construction of the Rasht-Astara railway, one of the most important projects between the two countries, will be signed in Tehran after the remaining issues are resolved.

The Rasht-Astara connection is seen as an important link in the corridor that will connect India, Iran, Russia, Azerbaijan, and other countries by rail and by sea. The 162 km railway along the Caspian Sea coast will will be an extension of railways from Russian ports on the Baltic Sea to Iranian ports on the Indian Ocean and Gulf of Aden.

The visit comes amid reports that Iran is selling ballistic missiles to Russia. The United States has condemned the reported sale as "dangerous escalation" of the conflict in Ukraine, warning of “swift and severe response from the international community.”

US National Security Council spokesman John Kirby said Thursday that the Biden administration will impose more sanctions on Iran for supplying drones to Russia, and it would go even “further” if it’s established that Iran has given Russia ballistic missiles, implying that the US government is yet to see clear evidence of that.

Iran and Russia are the two countries with the greatest number of US sanctions against them. The United States on Friday imposed extensive sanctions against Russia, targeting more than 500 people and entities to mark the second anniversary of Moscow's invasion of Ukraine and retaliate for the death of Russian opposition leader Alexei Navalny.

While Iran’s national currency shows no signs of bouncing back after a 13-percent fall since early January, Tehran says it does not recognize the free market exchange rates.

Minister of Economic Affairs and Finance, Ehsan Khandouzi, said Friday that “we certainly do not recognize the free market exchange rate officially.”

His remarks echo the regime’s propaganda line that the efforts to control the rial’s devaluation are effective. However, the rial has been hovering around 570,000 per dollar for ordinary people who have no access to currencies at the lower government rates.

Limited availability of foreign currency at the lower government rate has pushed buyers toward the unofficial black market. In an attempt to keep tabs on the unofficial foreign currency exchange market, the Iranian government has also criminalized a broad spectrum of "unauthorized" transactions, including those in the virtual space. However, these measures seem to have little impact on the currency's downward spiral. Currency exchange offices in Tehran are also forbidden from publicly disclosing rates.

The rial hit an all-time low late in January amid fears of US retaliation for a drone attack that killed three American servicemen in Jordan. The US dollar rose to nearly 600,000 rials, the highest since February 2022, when it briefly traded at that level.

The Iranian currency, which has steadily lost value since the 1979 revolution, has fallen about 13-fold since 2018, when then-president Trump pulled the United States out of the 2015 JCPOA nuclear deal and imposed sanctions on Iran’s oil exports and international banking. Since then, the dollar has risen from 42,000 to more than 570,000 rials. Before the establishment of the Islamic Republic in 1979, the dollar traded at 70 rials.

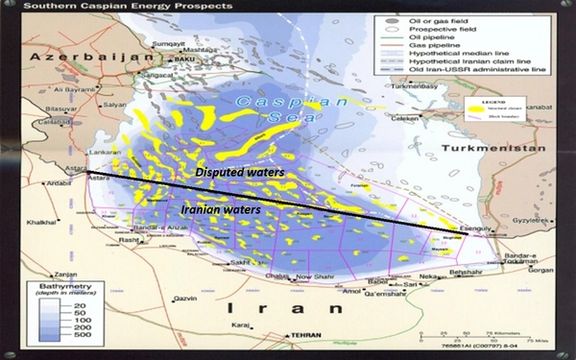

Iran is the only littoral state in the Caspian Sea that does not extract oil or gas, unlike Russia, Azerbaijan, and others, which have invested over $160 billion in Caspian fields.

All littoral states, except Iran, are aiming to increase oil and gas production from these fields in 2024. They collectively produced over 1.2 million barrels per day of oil and 50 billion cubic meters per year of gas from these fields in 2023.

BP’s vice president for the Middle East and Caspian communications and external affairs told Iran International that it plans to drill 24 wells in the Azerbaijani section of Caspian Sea in 2024, with one already nearing completion.

Bakhtiyar Aslanbayli added that the BP-led consortium is also preparing to launch a new platform in Azeri-Chirag-Guneshli (ACG) oil block. It also plans to drill a deeper well (4,200 meters) in ACG’s gas layer in late 2024 to start producing the dry gas from this field in the first quarter of 2025.

Iran remains the only Caspian littoral country that does not produce hydrocarbons from the sea. Despite attempts in the past, including seismic research and drilling wells, Iran has faced technical challenges and setbacks. The country's section of the Caspian Sea, with depths of up to 1,000 meters, presents significant technical and financial hurdles for exploration and development.

BP delivered 2 billion cubic meters (bcm) of associated gas from this oil block to Azerbaijan in 2023, but for first time it is preparing to produce dry gas from its deeper layer as well.

BP-led consortiums invested more than $5.1 billion in Azerbaijan’s offshore Shah Deniz gas field and ACG. These fields share more than 95% of the country’s oil and gas production.

French TotalEnergies also inaugurated another offshore gas field, Absheron, for Azerbaijan in July 2023 with initial 1.7 bcm/yr of gas and 12,000 b/d of ultra-light oil, called gas condensate. Azerbaijan’s state-run Socar and TotalEnergies have invested $1 billion in this project and plan to increase investments to quadruple the prodcution level by 2026.

Socar itself drilled 17,000 meters of oil and gas wells in other fields during 2023 as well. Azerbaijan produced 612,000 b/d of oil and 48 bcm of gas in 2023, almost totally from Caspian fields. It has absorbed more than $95 billion foreign investment in its Caspian oil and gas projects during 1996 to 2023.

Ilham Shaban, the director of Baku-based Caspian Oil Research Center told Iran International that Kazakhstan produced 407,000 b/d of oil and 1 bcm of gas from offshore Kashagan field in 2023. Italian Eni, the operator of this field, is preparing to start drilling in offshore Abay block, southwest of Kashagan in 2024.

Eni-led consortium has invested $60 billion in Kashagan, the biggest oil reservoir in Caspian Sea, as of now.

Qatari UCC Holding recently signed an $11 billion contract with Kazakhstan, including the construction of two gas processing plants for Kashagan with a capacity of 3.5 billion cubic meters per year. Additionally, Dragon Oil from the UAE, the only operating company in Turkmenistan’s offshore fields, plans to boost its oil production from Turkmen offshore fields to 100,000 barrels per day by early 2026, having invested around $6 billion in the projects.

Dragon Oil is currently producing 60,000 b/d of oil from Turkmen offshore fields and eyes boosting this volume to 100,000 b/d by early 2026. It has invested about $6 billion in Turkmen offshore oil and gas projects as of now.

In the Russian side of the Caspian, Lukoil has inaugurated Valery Grayfer field in 2023 after operating Korchagin and Filanovsky offshore fields during recent years. It produced about 150,000 bpd of oil in 2023 from Caspian fields and plans to start development of Khazri field in 2024. Lukoil has discovered 11 oil and gas fields in the Russian section of Caspian Sea.

Iran Still Waits

Iran conducted drillings in its shallow waters during the Soviet era and in 1990s without any result.

Iran has carried out seismic tests in 4000 square kilometers of the Caspian Sea at blocks 6,7,8 and 21 from 2003 to 2005, but the research vessel Pejwak caught fire and burned in 2005 and the exploration operations stopped.

After that Iran started to drill three wells in some blocks by its Amir Kabir drilling rig. However, its crane crashed in 2015 and now it is idle in Iranian waters.

After signing the JCPOA nuclear deal in 2014, Iran initiated negotiations with several international companies for Caspian projects, but no concrete results were achieved. With only 0.5 billion barrels of proven and probable reserves in the Caspian Sea, according to the US Energy Information Administration, Iran's upstream activity in the region remains limited. Despite claims of discovering a gas field in 2012, Iran's exploration and development efforts in the deep waters of the Caspian Sea face substantial challenges without foreign investment and expertise.

Iran's Expediency Discernment Council has approved the allocation of 13.6 billion euros for the import of essential, agricultural, pharmaceutical, and raw materials.

As announced by the Council’s Supreme Supervisory Board on Wednesday, the authorization allows the government and the Central Bank to utilize the allocated funds "solely for the import of essential agricultural goods, pharmaceuticals, and their raw materials, as well as medical consumables."

Amidst the drastic devaluation of the Iranian currency in recent years, the government has resorted to providing foreign currency at cheaper exchange rates to importers of a pre-approved list of essential goods, including medicine, food, and crucial raw materials. Importers are mandated to procure and transport the approved goods into the country.

The official exchange rate of the Iranian rial, subsidized by the state, stands at 285,000 rials per US dollar, significantly lower than the open market rate of about 570,000 rials per dollar. The official rate is exclusively utilized for importing essential goods, aiming to shield Iranian consumers from sudden and dramatic price increases due to sanctions.

However, concerns have been raised regarding the misuse of allocated foreign currency, with reports indicating that some individuals and companies fail to import the agreed-upon goods or sell them at inflated prices after importation.

In a recent example, Debsh company, responsible for a significant portion of the country's tea imports, reportedly received an astounding $3.37 billion in foreign currency from the government at a preferential exchange rate for tea and machinery imports between 2019 and 2022. However, reports suggest that the company has sold $1.4 billion of the currency on the free market at higher rates.

As Iran continues to work to evade global sanctions, one of the country's leading figures has admitted the regime is deliberately concealing its maritime activities to avoid scrutiny.

Jalil Eslami, Deputy Head of Iran's Ports and Maritime Organization (IPMO), emphasized the need for discretion regarding the ports where Iran faces traffic restrictions, saying, "Considering the current conditions, Iranian ships face restrictions on traffic in some ports, but it is not a good move to announce the names of those ports."

Eslami's statement follows the recent ban on Iranian ships at India's Mundra port due to sanctions measures and in the wake of earlier disclosures by Iranian transportation officials regarding maritime challenges globally.

While India has historically maintained friendly relations with Iran and has been a significant trading partner, it has also adhered to international sanctions regimes, particularly those imposed by the United Nations. The recent ban will have major economic consequences.

Masoud Daneshmand, a member of the board of directors at the Center of Transport Institutions, echoed the government's concerns, emphasizing the significant impact of sanctions on Iranian shipping assets.

In March, the United States imposed new sanctions targeting entities associated with Iran's shipping and petrochemical sectors, aligning with previous measures aimed at Iran's oil, banking, and transportation industries. Additionally, a cautionary advisory issued by the Office of Foreign Assets Control in 2019 warned global entities involved in shipping petroleum from Iran about potential repercussions.