Iran’s Rial Loses Value Over Mideast Escalation, Prospect Of Trump Victory

Despite extensive currency injections, Iran’s rial is on a nosedive amid heightened regional tensions and prospects of Donald Trump winning the US presidency.

Despite extensive currency injections, Iran’s rial is on a nosedive amid heightened regional tensions and prospects of Donald Trump winning the US presidency.

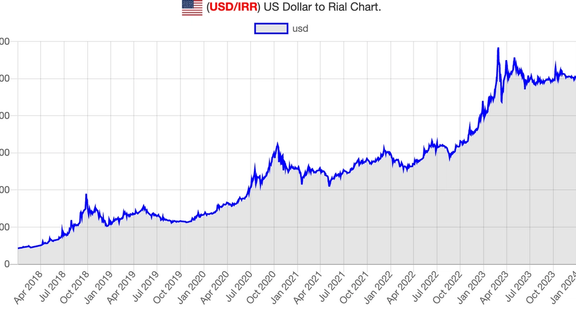

The rial fell to 562,000 against the US dollar on Saturday, as uncertainty grows about a military escalation in the region and Trump's successes in US Republican primaries.

UPDATE: The expected escalation happened quickly. Following the news on Sunday of an attack on a US base in Jordan where three US serviceman died, and President Joe Biden's threat of retaliation, the weakened rial fell further to 575,000 per dollar.

The Iranian currency has fallen about 13-fold since 2018, when then-president Trump pulled the United States out of the 2015 JCPOA nuclear deal and imposed sanctions on Iran’s oil exports and international banking.

Additionally, the price of the British pound and euro, which soared to record highs in Iran last Tuesday, experienced further escalation on Saturday. Each pound was traded for 714,200 rials, while each euro fetched approximately 610,000 rials in Tehran's free currency market, which despite some official exchange rates, reflects the real value of the rial against foreign currencies.

Amid the economic woes, Iran's leading economic newspaper Donya-e-Eqtesad has drawn attention to the potential ramifications of Trump's potential return to the White House, citing it as a factor contributing to the rise of foreign currencies and the price of gold. The paper also highlighted regional instabilities, particularly in the Red Sea, as factors fueling economic insecurity among Iranian investors. Last week, the devaluation of the rial intensified following Iran's ballistic missile strikes on targets in Iraq and Pakistan. Tensions were already heightened due to Iran-backed Houthis' assaults on commercial vessels in the Red Sea.

According to Donya-e-Eqtesad, market analysts attribute the rial’s freefall to various factors, including "increased cost of trade with Iraq," as well as the developments related to the US presidential elections.

However, state-run media in Iran claim that the rise in the foreign currency exchange rates is just a “bubble” created by those who seek to benefit from fluctuations in the market. Iran’s chief banker Mohammad-Reza Farzin claims that the country enjoys a “favorable foreign exchange reserves.” Farzin said last week that fluctuations in the market are transient.

Fars news agency, affiliated with Iran’s Revolutionary Guards, claims that the rial will bounce back in the coming days, speculating that rial’s will settle at about 520,000 per dollar.

Asr-e Iran, a moderate-conservative website, published an article arguing that the impact of the news about Trump’s victory on Iran’s currency market is trumpeted as a manipulation tactic aimed at creating a false psychological and media atmosphere and fostering speculative inflation in Iran.

Rejecting the assumption that Iran’s oil exports increased due to a lax enforcement of US sanctions under the Biden administration, Asr-e Iran said the real reasons behind the rise in oil revenues are the government's efforts to sell oil through unofficial channels and the recovery of the global energy market following the slump caused by the COVID-19 pandemic. It added that geopolitical repercussions of the Russian invasion of Ukraine and the OPEC+ decision, in collaboration between Russia and Saudi Arabia, to curb crude supply have also prevented market saturation and created opportunities for the sale of sanctioned oil, including the Iranian crude. A very significant factor is the willingness of small Chinese refineries, known as "teapots," to buy sanctioned oil at discounted rates, the article highlighted.

All in all, there is a rumor circulating in Iran that the government was trying its best – mainly through injecting foreign currency into the market -- to keep the wobbly rial stable until the re-election of Joe Biden, who is believed to have overlooked Iran's sanction-busting. However, the growing chance of Trump landing at the White House has dashed Tehran’s hopes for the steady flow of its oil exports.

Sajjad Bourbour, a senior economic pundit, told Centrist Aftab News that the Iranian currency market heavily depends on the prospects of Tehran mending relations with the West. He mentioned that despite the Central Bank’s injection of approximately 2 quadrillion rials (about $4 billion) into the market to prevent rial's fall, the currency is at its all-time low.

With an annual inflation rate of at least 50 percent, the diminishing value of the rial signals further inflationary pressures in the months ahead. Monthly wages for workers, averaging less than $200, exacerbate the challenges within an economy where inflation outpaces salary adjustments. Such economic strains have led to strikes and protests across various sectors, including oil and gas production platforms and refineries.