Iran’s Losses From Nuclear Sanctions Runs Into Trillions Of Dollars

Iran aims to start oil for goods barter with Pakistan as Tehran’s finances remain bleak with rising food, medicine prices and shortages amid ongoing sanctions.

Iran aims to start oil for goods barter with Pakistan as Tehran’s finances remain bleak with rising food, medicine prices and shortages amid ongoing sanctions.

Hadi Talebian Moqaddam, a trade official, told a news website in Tehran that soon Iran will invite Pakistan to hold talks about bartering commodities and goods, with an eye “on creating free trade.” He mentioned textiles as an area where Pakistan can supply Iran, although importing rice also has a long history.

US sanctions imposed since 2018 have seriously limited Iran’s oil exports and its revenues, which are vital for supplying hard currency to a government that controls the economy and is responsible for providing food and medicine to the population.

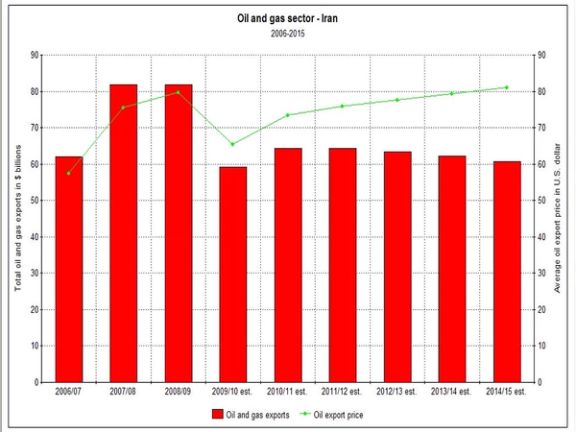

Although the oil exports have substantially increased in the past two years, the revenues have not been sufficient for all the needs of a population reaching 85 million and an inefficient economy mired with corruption and international isolation.

The US Energy Information Administration recently estimated that Iran’s total oil exports in 2023 will reach $46 billion, but it admitted that this a rough calculation based on global energy prices, not on actual amounts Iran charges its customers.

In fact, Iran and Russia, two sanctioned countries, offer large discounts to their buyers. The amount of the discounts remains secret, but some have said that Iran might be selling its oil in clandestine ways to small Chinese refineries for as low as $40 per barrel.

What is clear is that Iran must use middlemen who mix its oil shipments with cargoes from other countries, transfer the oil to other tankers somewhere in south-Asian waters and deliver it to China as Omani, Malaysian or Iraqi oil.

In addition, it is not easy to repatriate the money in hard currency since Iran is cut off from the international banking system mainly due to US sanctions. That too costs money. All these cuts into Iran’s oil revenues, which are probably half of what the US estimate shows.

Iran’s confrontational foreign policy and its controversial nuclear program have left it far behind other regional countries like Saudi Arabia that have huge oil revenues and invest it back into infrastructure. Saudi oil revenues in 2023 are expected to reach $223 billion – at least five times that of Iran.

The picture becomes clearer if per-capita oil revenues are considered. Saudi per capita income from oil in 2023 is estimated at $6,450 and Iraq’s $2,356, while Iran’s per capita revenue is a meager $516.

In this situation, the clerical regime in Tehran boasting of its revolutionary credentials has to turn to barter trade with Pakistan, a country facing its own serious financial crisis.

Current US sanctions are not the only external reason for Iran’s economic crisis. The first serious economic sanctions began appearing 15 years ago when the international community discovered a secret Iranian nuclear program, and the UN Security Council began imposing sanctions. Since then, Iran’s average rate of economic growth has been zero, although international sanctions were lifted when the JCPOA nuclear deal with world powers was signed in 2015. After a two-year reprieve, the United States pulled out of that accord and imposed its own unilateral sanctions.

In a recent article, a relatively independent website in Iran argued that the nuclear program has cost the country 4 trillion dollars in the past 15 years, in lost growth, inflationary damage, and lack of domestic and international investments. The issue, the article argued is not just lost oil revenues but its cumulative impact on the economy, including loss of business confidence.

While Iran sits on the world’s second largest natural gas reserves, its tiny Persian Gulf neighbor Qatar exports $120 billion of LNG annually. Iran cannot match that because no Western company is willing to provide capital and technology to expand Iran’s gas fields or tap into new ones. Iran's annual losses are estimated to be much more than what Qatar is exporting.