Belt And Road Initiative, China’s Great Game

China is now the single largest investor and trading partner to 11 Middle Eastern countries, thanks primarily to its Belt and Road Initiative (BRI), a global, multi-trillion-dollar project.

China is now the single largest investor and trading partner to 11 Middle Eastern countries, thanks primarily to its Belt and Road Initiative (BRI), a global, multi-trillion-dollar project.

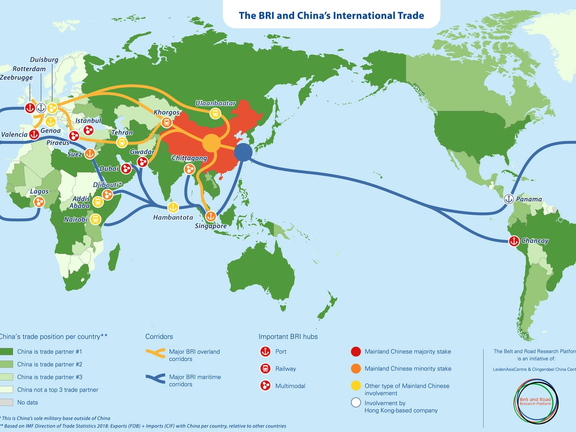

China has significantly increased its economic, political, and security footprint in the Middle East through the BRI during the past decade. The ‘Belt’ runs from China, through South and Central Asia, and into Europe. The Maritime “road” connects coastal Chinese cities with Africa and the Mediterranean.

The Center for Economics and Business Research (CEBR) reported that China’s Belt and Road Initiative is likely to boost world GDP by $7.1 trillion annually within the next two decades. As attractive as that might sound, in addition to economic activity, China has geopolitical motivations behind its Belt and Road Initiative.

According to The Guardian, BRI projects have left 165 countries collectively owing a massive $385 billion to China. China systematically underreports stats like this to international bodies, such as the World Bank.

The Information office of the Chinese government reports the BRI has created more than 244,000 jobs for locals overseas. However, a vast majority of BRI projects require the use of Chinese companies, labor, and raw materials, meaning the GDP gains from BRI will go to the Chinese ‘locals,’ not to the locals of the countries in which China has invested.

Energy Security of People’s Republic of China

China’s top economic agencies have singled out “security” as a priority for 2022. In other words, securing the supplies of everything from grains to energy and raw materials. According to The Brookings Institution, “China’s growing role in the Middle East is positioning the rising superpower in direct confrontation with shifting U.S. interests in the domains of energy security, Israel, and Iran.”. The US finds itself reducing its footprint in the Middle East and shifting its focus towards the Asia-Pacific, giving China the opportunity to expand its influence in the region. Chinese economic dominance may invite similar regional skirmishes as the country seems happy to leverage risky debt against the countries it invests in to get what it wants diplomatically.

China’s relationship with the Middle East revolves primarily around Energy and the BRI. The Middle East and North Africa (MENA), a collective of 19 counties, has vast oil, petroleum, and natural gas reserves, making it attractive to China.

According to China Global Investment Tracker, Beijing heavily depends on Middle Eastern oil and gas. In addition to energy security, China’s strong diplomatic ties with MENA countries are vital to implementing BRI across several continents. Chinese State-owned lenders have been financing projects in Egypt, Iran, Saudi Arabia, Oman, the United Arab Emirates, and Djibouti, where Beijing has established its only overseas military base.

Djibouti, located in ‘The Horn of Africa’, also hosts U.S., French, and Japanese military bases. The international interest in Djibouti lies in the Bab El-Mandeb Strait, a strategic route for oil and natural gas shipments, connecting the Red Sea and the Indian Ocean. Its location makes the choke point geopolitically and economically significant.

The Energy Information Administration (EIA) reports, approximately “6.2 million barrels per day of crude oil, condensate, and refined petroleum products flowed through the Bab El-Mandeb Strait towards Europe, the United States, and Asia.” One-third of the world’s ships transporting energy and cargo must pass through the strait. Bab El-Mandeb is one among a series of trade and energy corridors in which China has invested stretching from the South China Sea to the Arabian Sea, referred to by India as a “String of Pearls.” India sees this investment as a sign of China’s growing military and trade prowess in the region. Indian critics are worried the BRI is a military initiative, aiming to give the Chinese Navy better access to the Indian Ocean.

China’s maritime “road” now stretches from western Xinjiang, through India, into the Persian Gulf. To implement BRI, China will need to achieve energy security within the Middle East, to keep its pace of development. To achieve energy security, China needs bases at every strategic port and chokepoint. As for the Gulf states’ approval of China, Iran announced the opening of a Chinese consulate in Bandar-Abbas, Iran’s most significant trading and military port on December 29th, 2021. Beijing has maintained close ties with Iran amid nuclear negotiations with the U.S. Iran recently signed a 25-year cooperation agreement with China, allowing China to invest $400 billion over 25 years in Iran. The Supreme Leader of Iran, Ayatollah Ali Khamenei, said, “The Islamic Republic will never forget China’s cooperation during the sanctions era.” It is essential to keep in mind, Iran’s cooperation with China may be a non-calculated reaction to its bad relations with the United States, and not a calculated strategic move on Teheran’s part, for its long-term development and international trade.Sorely needed economic injection investee countries like Iran, will receive from China, position China to earn favorable diplomatic preference throughout the developing regions through which BRI is implemented.

Debt-Trap-Diplomacy or Investee’s Incompetence?

China has been accused of strategically ensnaring investees with “debt-trap- diplomacy.” Unsustainable debt and the constrictive terms of Chinese loans have come under increased scrutiny in recent years, as more countries sign deals with China’s state-owned lenders. Concerns have centered particularly around some clauses that allow Chinese entities to seize property or assets when payments can’t be met. This has prompted worries of seizures of land or other assets, or debts that leave governments beholden to Beijing.

MI6 chief Richard Moore warned the BBC that China’s approach to loans often incorporates debt and data traps, which threaten to “erode sovereignty and have prompted defensive measures.”To vividly illustrate what Chinese debt traps look like in practice, observe the cases of Sri Lanka, Kyrgyzstan, and Montenegro, which are all falling short on their loan obligations to China, which refuses them self-sustainable growth.

Sri Lanka is currently experiencing a financial crisis from debts owed to China for highways, ports, airports, and a coal power plant. Sri Lanka’s President, Gotabaya Rajapaksa, has requested that China consider restructuring Sri Lanka’s debt repayments. According to Reuters, over the last decade, China has lent Sri Lanka over $5 billion.” Critics say China uses white elephant projects with low returns, which China has denied.

Similarly, Kyrgyzstan owes 40% of its foreign debt, $1.8 billion, to Chinese lenders. They grapple with repayments and meeting deadlines as the country faces financial troubles brought on by the COVID-19 pandemic.

In Montenegro, worries flared up after the government requested help from the European Union (EU) to pay off a $1 billion Chinese loan for a controversial, ongoing highway project. Montenegro’s economy is on the verge of derailment as a result: Montenegro’s debt has climbed to 100% of its GDP due to this project.What’s worse, “once completed, the road won't lead anywhere anyway. We make a joke: It is ahighway from nothing to nothing," says the country's former Justice Minister, Dragan Soc. The EU’s refusal to help Montenegro to pay its debt is an opportunity for China to grow its influence and foothold in Europe. Scott Morris, a senior fellow at the Center for Global Development says, “China is the top lender in the world, so it matters how it approaches these contracts.” Morris continues, “the general conclusion after looking at the contracts is that Chinese entities are issuing loans with the full intention of getting their money back.” China seems equally happy to swap debt for rights, ownership, and influence when the prospect of financial repayment becomes bleak for investees.

The ‘Non-Interference’ Policy, a False Sense of Security

China is using a ‘Non-interference’foreign policy, to differentiate its approach from the US, creating a false sense of security, as the very nature of BRI is invasive. China’s ’Non-interference’ policy, combined with the implementation of the BRI’s opaque contracts, creates opportunities for China to prevent having to take accountability for its actions abroad, similarly to how it’s already doing so domestically.

China needs the GCC’s approval to gain energy security in the region. Chinese Foreign Ministry spokesperson, Wang Wenbin said the Gulf Cooperation Council (GCC) Secretary-General, Nayef Falah Al-Hajraf, expressed firm support for China’s “legitimate positions on issues related to Taiwan, Xinjiang and human rights,” when the GCC members met with Chinese officials in Beijing early January of 2022. Wang continued to say they have expressed opposition to “politicization of human rights issues.”

United Nations revealed in 2018, that China has detained more than a million Muslim Uyghurs in the Xinjiang region as part of a campaign to wipe out their traditional culture, language, and beliefs. Al-Hajraf’s support of China’s detainment of Uyghurs, on behalf of the GCC—a body representing more than 54 million Muslims—sets an unsettling precedent for the way those populations may get treated in MENA countries through which the BRI extends.

China’s ‘Non-Interference’ foreign policy seems to be gaining attraction among authoritarian countries with stagnant economies; one being Iran. The Iran-China 25-year Cooperation Agreement is signed at a time when Iran is politically and economically isolated, which could have affected the terms of the agreement. The BRI’s record of economy-crippling projects in countries with economies stronger than Iran’s means that Iran may have a difficult 25 years ahead.