UAE Restricting Money Transfer To And From Iran – Report

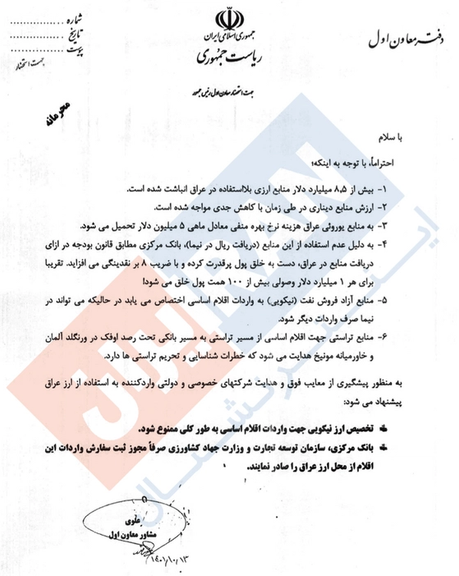

Following restrictions on the Islamic Republic’s financial operations in Iraq, available information indicates that the UAE is also limiting money transfers to and from Iran.

Following restrictions on the Islamic Republic’s financial operations in Iraq, available information indicates that the UAE is also limiting money transfers to and from Iran.

According to information obtained by Iran International, it has become more difficult for Iranian businesspeople in the United Arab Emirates to transfer money in dirhams, and merchants do not have the leeway they used to have to transfer funds between the two countries.

According to an exchange office in Dubai, well-known merchants and those working in the food industry have faced fewer problems, but large exchange offices and banks are acting more cautiously when it comes to Iranian customers. The source added that some of them have completely stopped working with Iranians.

The development revelation comes one day after Iran International leaked a letter revealing that the Islamic Republic is suffering from heavy financial losses because a huge amount of its money is blocked in Iraq. According to a confidential letter addressed to First Vice-President Mohammad Mokhber by his advisor, Iran has $8.5 billion in funds from exports of gas and electricity that is frozen in Iraq as a result of US sanctions. In early February, Iran International obtained information that revealed some details about the inner workings of a Revolutionary Guard’s Quds force unit tasked with smuggling money from Iraq to Iran.

The Islamic Republic has a vast network of cover companies and businesses to transfer money in the region without the restrictions put in place due to the US sanctions. However, more and more regional countries have started direct coordination with the US that would eventually prevent Iran from circumventing the sanctions.

A document obtained by Iran International has revealed that Russian companies are not willing to invest in oil and gas projects in southern Iran, despite joint projects.

In a top-secret letter addressed to First Vice-President Mohammad Mokhber, Deputy Foreign Minister for Economic Diplomacy Mehdi Safari said that many development projects that were supposed to be carried out by Chinese and Russian companies have been stopped, calling on the government to take measures to re-start the projects.

In his letter, Safari mentioned the South Pars/North Dome Gas-Condensate field, Azar Oil Field in Ilam Province, Changouleh oil fields in West Karoun region and Darkhovein oil field and Mansouri Oil Field in Khuzestan and several others in which the Russians had planned to invest but refrained to do so. The Shadegan and Kupal oil fields were also mentioned in the letter, adding that the government has not issued the needed permits for the Russian investors to continue their planned projects.

The letter called on the administration to provide incentives for the Russians who are reluctant to implement the projects, especially on the South Pars field. He said further negotiations or inviting delegations from Russia may help speed up the implementation of the projects.

The South Pars gas field in the Persian Gulf waters adjacent to Qatari fields is specially important for Iran as production has been steadily declining due to lack of technology to compensate for the fall in natural pressure. Under sanctions, Iran is not able to sign contracts with major Western oil companies who can build larger platforms and use more powerful pumps. Oil minister Javad Owji has said that Iran also needs to invest $40 billion in its gas industry – money it currently does not have.

Safari said that Chinese companies may be good alternatives for the Russian companies, but another leaked document has revealed that Chinese firms are not so willing to invest in Iran either. President Ebrahim Raisi visited China this week to persuade Beijing to operationalize a 25-year cooperation agreement with the Islamic Republic, but China is probably reluctant to violate US sanctions and is not certain about the future of the regime in Tehran. It has only expressed readiness to help in the revival of the 2015 nuclear deal.

The last chance Iran had for collaboration with a Western energy giant was a $5 billion deal it had struck with Total in 2016 to develop the South Pars gas fields, which fell apart in 2018 when former US president Donald Trump withdrew from the Iran nuclear deal and began imposing sanctions.

No substantial investment has been made since. Even the Chinese have not been active despite repeated claims that they would develop the country’s energy sector. Without a comprehensive deal with the United States to resolve differences, no serious international investor would commit to the Iranian market.

In October, a top oil official in Iran said that if new investments are not made in natural gas industry, the country will become a net importer in the next few years. Iran has the second largest natural gas reserves in the world, holding more than 17 percent of global discovered gas fields, but the government had to implement power cuts this winter, as it could not supply enough gas to power plants that have to switch to dirty liquid fuels.

Iran’s gas fields, like any other in the world and similar to Qatar’s, have a natural production curve and underground pressure that pushes the gas out declines over time, needing modern technology to maintain production level. Qatar has invested in 20,000-ton production platforms, not only maintaining output but even increasing production.

Chinese and Iranian presidents called on Thursday for the lifting of sanctions on Iran as an integral part of a stalled international accord on its nuclear program.

China’s Xi Jinping also accepted an invitation from Raisi to visit Iran and would do so at his convenience, the two leaders said in a joint statement on the last day of a three-day state visit to China by Raisi.

The leaders called for the implementation of the 2015 Iran nuclear agreement, known as the Joint Comprehensive Plan of Action (JCPOA).

In 2018, the then US president, Donald Trump, withdrew the United States from the deal and ordered the reimposition of sanctions on Iran.

President Joe Biden said in 2021 that the United States would return to the deal if Iran moved back into compliance, but talks have stalled since September 2022.

"All relevant sanctions should be fully lifted in a verifiable manner to promote the full and effective implementation," Xi and Raisi said.

China and Iran emphasized that lifting sanctions and ensuring Iran economic benefits were important components of the agreement.

On Tuesday, Xi told Raisi that China would "participate constructively" in talks to resume negotiations on implementing the agreement, while expressing his support for Iran in safeguarding its rights and interests.

"China firmly opposes interference by external forces in Iran's internal affairs and undermining Iran's security and stability," the leaders said in the statement.

The two leaders also drew up several initiatives, including promoting e-commerce and agriculture, but no major deal has yet been announced that could help Iran alleviate a serious economic crisis it faces.

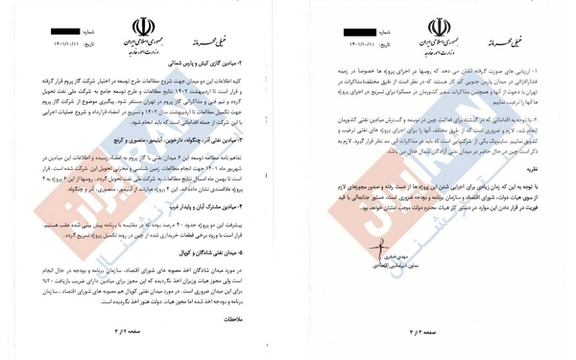

Iran International has obtained information that the Islamic Republic is suffering from heavy financial losses because a huge amount of its money is blocked in Iraq.

According to a confidential letter addressed to First Vice-President Mohammad Mokhber by his advisor, Iran has $8.5 billion in funds from exports of gas and electricity that is frozen in Iraq as a result of US sanctions.

In the letter, issued in early-February, the advisor, named Alavi, claimed that Iran is losing $5 million per month due to the “Negative Interest Rate.” He also added that the funds that are kept in Iraqi currency dinar are also losing their value.

The letter also reveals that the Central Bank of Iran is printing money on the basis of the frozen funds without being able to receive the money to add it to its reserves. It means that the printed money has no real back-up and aggravates inflation and leads to the devaluation of the rial, which hit new lows almost every day this week. According to the letter, Iran is printing one million rials for each dollar blocked in Iraqi banks, although the real exchange rate of dollar in Tehran is about 470,000 rials.

The biggest immediate reason for printing money is government borrowing from the Central Bank of Iran (CBI) to bridge its budget deficit estimated to be 50 percent. But the CBI has little gold or foreign currency reserves to back the rial banknotes it prints. The rial is not a fungible currency like the US dollar and no one invests in buying excess rials, the same way hard currencies function and maintain their value.

As Iran’s economic situation worsens, the Islamic Republic is printing money without backing and adds it to the money supply. Iran has been lavishly printing more money since 2018 when the United States imposed economic sanctions after it withdrew from the Obama-era nuclear accord known as the JCPOA.

The advisor also warned Mokhber about the funds that are spent on essential goods, which are not included in the US sanctions, saying that the money should be spent on other goods. He also said that some of the money is spent through trust funds that are under the audit by the US Office of Foreign Assets Control, and therefore can be tracked by the OFAC and put under further restrictions.

Iraq is seeking accession to the Paris-based Financial Action Task Force (FATF), the money-laundering watchdog that has blacklisted Iran. The FATF blacklist carries with it no formal sanctions, but financial institutions shift their resources and services away from blacklisted countries so as not to risk legal complications. The leaked letter can be an indication that the Islamic Republic has to find new ways to transfer money across the region, especially to fund its proxy forces.

On Saturday, February 11, Iraqi Foreign Minister Fuad Hussein -- accompanied by Central Bank of Iraq Governor Ali al-Allaq -- met with Secretary of State Antony Blinken, Deputy Secretary of the Treasury Wally Adeyemo, and other US officials and business leaders in Washington to discuss a host of economic issues. But an urgent issue was how to prevent Iran from using Iraq’s banking ties with the United States to launder US dollars and circumvent Washington’s sanctions.

In early February, Iran International obtained information that revealed some details about the inner workings of a Revolutionary Guard’s Quds force unit tasked with smuggling money from Iraq to Iran. According to the information, the IRGC and the Islamic Republic’s embassy in Iraq are involved in the money laundering operations that aim to funnel the regime’s revenues from oil and gas exports back to Iran. As per a repeatedly extended sanctions’ waiver by Washington, Tehran is only allowed to import medicine and some essential goods in exchange for its exports of gas and electricity to its neighboring country.

Earlier in the month, Abdol-Amir Rabihavi, the business adviser of the Islamic Republic in Iraq, claimed Iran’s exports to Iraq are on the rise approaching $10 billion despite pressure by the United States on Baghdad to stop the IRGC’s money smuggling from the Arab country.

According to an article by Forbes, Iran is thought to have well over $100 billion in funds trapped in banks in Iraq, South Korea, Japan, Canada and elsewhere.

Canada's CBC news channel says its investigation shows that three businessmen accused of cooperating with the Islamic Republic of Iran live in Canada.

These people are accused of hiding hundreds of millions of dollars in aid to the Islamic Republic to bypass US sanctions.

CBC News has introduced them as active businessmen in Canada who promote themselves as leaders in the world of real estate.

Salim Henareh promotes himself on his personal website as the CEO of a private mortgage corporation in Toronto and a “top name in his industry.”

Khalil Henareh, whose relationship to Salim has not been clarified, has identified himself on social media as a real estate broker based in Thornhill, Ontario.

The third one, Saeed (Sam) Tarab Abtahi, has been introduced on the company's website as the vice president of a private lending company tied to Salim Henareh.

“They are not accused of violating sanctions in Canada or of any illegal acts here. But all three men face felony charges in the US and up to 20 years in prison if they’re convicted,” wrote CBC News.

But Garry Clement, a former Royal Canadian Mounted Police superintendent said it appears to be a “classic example” of Canada acting as a “safe haven.”

Prime Minister Justin Trudeau has promised that Canada will no longer be a safe haven for people benefiting from “the corrupt and horrific regime in Iran.”

Iran has decided to develop its unfinished oil projects as Chinese companies are unwilling to continue joint plans, Iran’s oil ministry website reported Tuesday.

SHANA, the oil ministry’s news service quoted the director of Yadavarn Development Plan in southwest Iran as saying that “the development of the Yadavaran joint oilfield is expected to resume [by Iranian experts] in the next Iranian year (March 2023-24) with a credit line of $400 million.”

Mojtaba Moradi, an official, told SHANA that “the project seeks to increase the production capacity of the field by 42,000 barrels per day.”

“After about a six-year hiatus in development activities, the implementation of the project to increase the field’s output will begin,” he underlined.

“The development project will be carried out by Iranian experts and engineers, using domestically made parts and equipment,” he noted.

The development comes as President Ebrahim Raisi in is Beijing this week on an official visit discussing the implementation of a 25-year cooperation pact signed in 2021 as a general outline, but details have not been worked out.

However, according to moderate news website Rouydad 24, Moradi did not mention why the project is now being carried out by Iranian experts.

The Yadavaran hydrocarbon deposit shared with Iraq is located 70 kilometers west of the city of Ahvaz in Khuzestan Province near the Iraqi border.

Based on studies, the field's crude reserve is more than 34 billion barrels. The reserve's recovery rate for light and heavy crude oil stands at 15% and 7% respectively. Around 83,000 barrels of Yadavaran production are a blend of light crude and the rest is heavy crude.

Rouydad 24 quoted informed sources as saying that after the unofficial withdrawal of the Chinese company Sinopec, the National Iranian Oil Company has decided to continue the development of this field on its own.

“It is quite clear that the National Iranian Oil Company has reached a dead end in the negotiations with the Chinese and now decided to implement the second phase itself,” added Rouydad 24.

The Chinese have not yet reacted to the announcement, but according to the contract signed by the Ahmadinejad administration with Sinopec in 2007, the Chinese company developed the first phase, and the second phase was also supposed to be carried out by the same company. Sinopec started negotiations for the second phase in 2016, but so far there has been no result.

According to the deal Sinopec had a 51-percent share in the oil field, but it appears Beijing has been wary of violating US sanctions on Iranian oil exports, although it buys illicit shipments of crude from Iran.

The Chinese have said that the imposition of US sanctions against Iran in 2018 has hampered the process and that they should wait.

“When the Raisi administration took power, they were optimistic that the Chinese would invest in this field, but Beijing, for the time being, has no intention of investing there,” stressed Rouydad 24.

“In the past two years, the Chinese have increased their investment in countries like Saudi Arabia, the UAE, Kuwait, Iraq, and even Afghanistan, and have removed Iran from list of their priorities for the time being,” Rouydad 24 went on to say.