Saudi Defense Minister Khalid bin Salman will visit Tehran on Thursday, according to Qatari television Al-Araby TV.

Saudi Defense Minister Khalid bin Salman will visit Tehran on Thursday, according to Qatari television Al-Araby TV.

The US Treasury on Wednesday imposed sanctions on an independent Chinese refiner as well as several vessels and firms it said were involved in the sale of Iranian oil to China, even as US-Iran talks were due to resume on Saturday.

"Today, the Department of the Treasury’s Office of Foreign Assets Control (OFAC) is designating a China-based independent 'teapot' refinery Shandong Shengxing Chemical Co., Ltd. for its role in purchasing more than a billion dollars’ worth of Iranian crude oil, including from a front company for Iran’s Islamic Revolutionary Guard Corps-Qods Force (IRGC-QF)," it said in a statement.

The announcement imposed sanctions on five vessels it said were part of Iran's oil "shadow fleet" shipping oil to China.

“Any refinery, company, or broker that chooses to purchase Iranian oil or facilitate Iran’s oil trade places itself at serious risk,” secretary of the treasury Scott Bessent said in the statement.

“The United States is committed to disrupting all actors providing support to Iran’s oil supply chain, which the regime uses to support its terrorist proxies and partners.”

Iranian Foreign Ministry spokesperson Esmaeil Baghaei on Wednesday appeared to criticize Washington for toughening its stance on Iranian nuclear enrichment.

“Moving the goalposts constitutes a professional foul and an unfair act in football,” Baghaei wrote on X. “In diplomacy… (it) could simply risk any overtures falling apart.”

On Monday night, US envoy Steve Witkoff spoke of a possible enrichment cap at 3.67% but the White House seemed to walk back that position the next day, saying President Donald Trump seeks the full termination of Iran’s nuclear program.

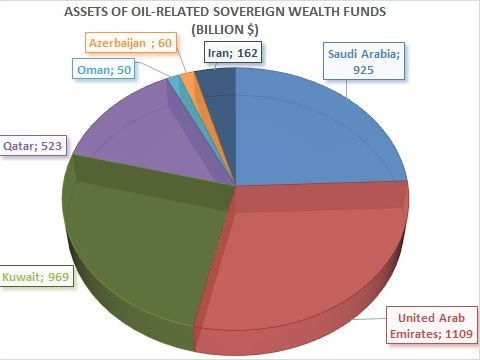

While sovereign wealth funds tied to oil revenues in Iran’s neighboring countries have surpassed $3.6 trillion, a new report by the Iranian Parliament Research Center reveals the extensive depletion and misuse of Iran’s National Development Fund (NDF).

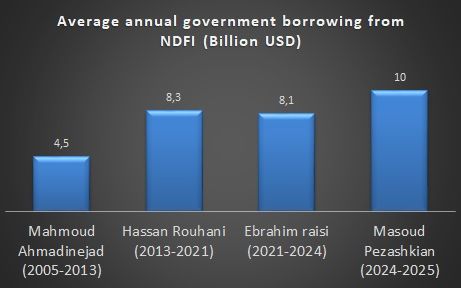

According to data from the Parliament Research Center, between the establishment of the National Development Fund (NDF) in 2011 and March 2024, about 82% of its $161 billion in revenue has been spent. Notably, 88% of the loans disbursed by the fund went to the government and public institutions, including the Islamic Revolutionary Guard Corps (IRGC). In effect, a fund intended as a savings mechanism for oil revenues has instead served as a financial lifeline for inefficient state entities.

Of the $132 billion in loans disbursed over the past 13 years, only $8 billion has been repaid, while $18 billion is past due and classified as non-performing.

The report also reveals that as of March 2024, the fund’s foreign exchange reserves had fallen to just $26.5 billion. After accounting for $6.5 billion in outstanding obligations, only $20 billion remains in accessible assets.

The NDF has yet to release its financial report for the past fiscal year, which ended on March 20, but investigations by Iran International indicate that the government borrowed at least $10 billion from the fund last year. This borrowing occurred either directly through authorization from Supreme Leader Ali Khamenei, or by seizing a portion of the fund’s share from oil export revenues as permitted by the national budget law.

Under the current fiscal year’s budget, the government is also set to borrow at least $9.4 billion out of the fund’s projected $16 billion in oil revenue.

The fund was established 14 years ago to save a portion of Iran’s oil revenues and provide loans to the private sector, replacing the former Foreign Exchange Reserve Account. However, in practice, the government and military forces took control of most of its financial resources. Only $14 billion—less than 10% of the fund’s assets—was allocated to the private sector. Given the extent of corruption and cronyism, it is unlikely that these resources reached the true private sector.

If no further unexpected withdrawals are made by the government this year, the total state debt to the fund, or spent money, will reach $125 billion by the end of the year.

The critical issue is that the Iranian government lacks the financial resources to repay its debts, and the NDF is now attempting to offset part of the government’s liabilities by investing in oil fields and selling crude oil directly. This approach not only contradicts the fund’s original purpose, but it could effectively cut the government off from its own oil export revenues.

In the past few months, the government has projected daily oil exports of 1.5-1.8 million barrels, one-third of which is to be handed over directly to military institutions. If the NDFI also becomes a direct oil exporter, the government’s role in oil exports will be further marginalized.

Situation in Neighboring Countries

While the NDF’s manageable assets have fallen below $20 billion, data from the Global SWF Institute indicates that the total reserves of oil-related sovereign wealth funds in the Persian Gulf countries and Azerbaijan have surpassed $3.6 trillion. In addition to this, these states also possess a similar amount in other sovereign wealth funds.

For example, the United Arab Emirates manages eight sovereign wealth funds with total assets of $2.3 trillion. Among them, only the Abu Dhabi Investment Authority (ADIA) is oil-funded, with more than $1.1 trillion in assets.

Beyond the $6.7 trillion in sovereign wealth fund assets—whether linked to oil or not—public pension funds in these oil-rich neighboring states also hold around $650 billion in capital. In contrast, Iran’s public pension funds have been effectively bankrupt for years, surviving only through annual government budget allocations.

Moreover, the foreign currency reserves of the central banks in the Persian Gulf Arab countries exceed $850 billion, whereas, according to the Global SWF Institute, Iran’s Central Bank holds just $25 billion in reserves—most of which has been lent to the government and domestic banks in the form of loans and credits.

While the National Development Fund accounts for less than 0.5% of the region’s sovereign wealth fund assets, Iran possesses the second-largest oil reserves in the region after Saudi Arabia and ranks first in natural gas reserves.

Iran also has the third-highest oil production in the region after Saudi Arabia and Iraq, and it is the largest producer of natural gas in the Middle East.

Decades of flawed policymaking, rampant corruption, and the plundering of national wealth—combined with the impact of international sanctions—have steadily crippled Iran’s financial institutions.

Iran’s state broadcaster confirmed on Wednesday that the second round of nuclear talks between Tehran and Washington will take place in Rome this Saturday, with Oman’s Foreign Ministry again acting as host.

The second round of US-Iran nuclear talks scheduled for Saturday will be held in Rome, three sources told Axios correspondent Barak Ravid on Wednesday.

Iran’s Foreign Ministry had said on Tuesday that Muscat would host the talks due to logistical reasons, following earlier reports naming Rome as the venue.